Zydus Share Price Target 2025 To 2030- Current Chart, Market Overview

Zydus Lifesciences, earlier known as Cadila Healthcare, is one of India’s well-known pharmaceutical companies. The company is dedicated to providing affordable and quality medicines, not just in India but across the world. Zydus has a strong presence in both generic and specialty medicines, and it continues to grow in areas like vaccines, biotechnology, and wellness products. Zydus Price on NSE as of 10 April 2025 is 846.00 INR.

Zydus Price Chart

Zydus Market Overview

- Open: 840.40

- High: 849.85

- Low: 823.30

- Previous Close: 859.10

- Volume: 1,594,419

- Value (Lacs): 13,463.27

- VWAP: 840.69

- UC Limit: 945.00

- LC Limit: 773.20

- 52 Week High: 1,324.30

- 52 Week Low: 795.00

- Mkt Cap (Rs. Cr.): 84,966

- Face Value: 1

Zydus Price Target 2025 To 2030

| Zydus Price Target Years | Zydus Price |

| 2025 | ₹1330 |

| 2026 | ₹1400 |

| 2027 | ₹1500 |

| 2028 | ₹1600 |

| 2029 | ₹1700 |

| 2030 | ₹1800 |

Zydus Price Target 2025

Zydus share price target 2025 Expected target could be ₹1330. Here are 8 key factors affecting the growth of Zydus (Zydus Lifesciences) share price target for 2025:

-

New Drug Approvals

If Zydus receives more approvals for its new drugs in India and globally, it can boost sales and investor confidence. -

Growth in Exports

Increasing exports, especially to the US and other regulated markets, can play a big role in revenue growth. -

Research and Development (R&D) Investments

Higher spending on R&D can help Zydus bring innovative products to market, supporting long-term growth. -

Generic Drugs Portfolio Expansion

A wider range of generic drugs can open up new markets and strengthen the company’s position in the pharma industry. -

Healthcare Demand Post-Pandemic

The rising focus on healthcare after the pandemic could benefit companies like Zydus, which offer vaccines and essential medicines. -

Regulatory Environment

Positive changes or stable regulations in India and international markets can help smoothen operations and expansion. -

Cost Management

Efficient control of manufacturing and operational costs will directly improve profit margins and overall financial health. -

Strategic Partnerships and Acquisitions

Collaborations or acquisitions can give Zydus access to new technologies, markets, and customer bases, fueling future growth.

Zydus Price Target 2030

Zydus share price target 2030 Expected target could be ₹1800. Here are 8 key factors affecting the growth of Zydus Lifesciences share price target for 2030:

-

Global Market Expansion

By 2030, Zydus is expected to strengthen its presence in global markets, especially the US and Europe, which can significantly boost revenues. -

Pipeline of Innovative Products

A strong focus on innovation, including vaccines, biologics, and specialty medicines, can open new growth avenues. -

Adoption of Advanced Technologies

Using advanced technologies like biosimilars and gene therapy will help Zydus stay competitive and tap into future healthcare trends. -

Focus on Wellness and Preventive Healthcare

With growing awareness about health and immunity, Zydus’s wellness products and preventive medicines can see higher demand. -

Sustainability Initiatives

Investing in sustainable and eco-friendly practices can enhance the company’s reputation and attract ethical investors. -

Government Policies and Support

Supportive healthcare policies and incentives for pharmaceutical exports can create a favorable environment for growth. -

Strong Financial Management

Maintaining healthy cash flows and reducing debt can strengthen the company’s position in the long term. -

Growing Chronic Disease Segment

The increasing global burden of chronic diseases like diabetes, hypertension, and cancer creates steady demand for Zydus’s treatments.

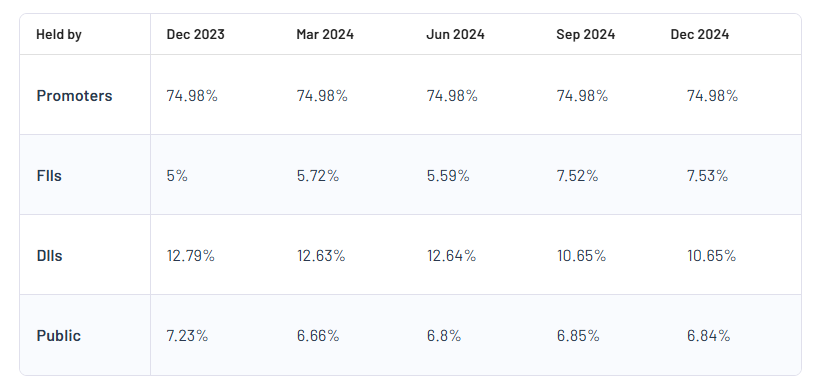

Zydus Shareholding Pattern

| Promoters | 74.98% |

| FII | 7.53% |

| DII | 10.65% |

| Public | 6.84% |

Read Also:- Zydus Share Price Target 2025 To 2030- Current Chart, Market Overview