Zen Technologies Share Price Target 2025 To 2030- Current Chart, Market Overview

Zen Technologies is an Indian company that specialises in making advanced defence training and simulation systems. Founded with the goal of supporting the country’s defence forces, Zen focuses on creating smart solutions like combat training simulators, anti-drone systems, and weapon simulators. The company plays an important role in helping soldiers and security personnel prepare for real-life situations in a safe and controlled environment. Zen Technologies Price on NSE as of 10 April 2025 is 1,444.05 INR.

Zen Technologies Price Chart

Zen Technologies Market Overview

- Open: 1,409.95

- High: 1,468.75

- Low: 1,380.10

- Previous Close: 1,428.85

- Volume: 367,267

- Value (Lacs): 5,321.33

- VWAP: 1,427.55

- UC Limit: 1,500.25

- LC Limit: 1,357.40

- 52 Week High: 2,627.00

- 52 Week Low: 886.45

- Mkt Cap (Rs. Cr.): 13,082

- Face Value: 1

Zen Technologies Price Target 2025 To 2030

| Zen Technologies Price Target Years | Zen Technologies Price |

| 2025 | ₹2630 |

| 2026 | ₹3050 |

| 2027 | ₹3450 |

| 2028 | ₹3900 |

| 2029 | ₹3350 |

| 2030 | ₹3800 |

Zen Technologies Price Target 2025

Zen Technologies share price target 2025 Expected target could be ₹2630. Here are 8 key factors affecting the growth of Zen Technologies share price target for 2025:

-

Government Defence Spending

Increased focus on strengthening India’s defence sector and higher government budgets for modernisation can boost orders for Zen Technologies. -

Export Opportunities

Growing global demand for advanced defence training and simulation equipment opens up new international markets for Zen. -

Make in India Initiative

Support from the “Make in India” program helps the company gain preference in defence contracts, promoting domestic manufacturing. -

Innovation in Defence Technology

Zen’s continuous efforts in developing advanced technologies like drones, combat simulators, and anti-drone systems can attract more clients. -

Strategic Partnerships

Collaborations with global defence companies can help Zen expand its reach and improve its technological capabilities. -

Policy Support and Reforms

Supportive policies such as defence procurement policy (DPP) and ease of doing business in defence manufacturing benefit the company. -

Strong Order Book

An increasing number of orders from Indian armed forces and paramilitary units can ensure steady revenue growth. -

Geopolitical Environment

Rising security concerns and focus on self-reliance in defence across the world could push demand for Zen’s products and solutions.

Zen Technologies Price Target 2030

Zen Technologies share price target 2030 Expected target could be ₹3800. Here are 8 key factors affecting the growth of Zen Technologies share price target for 2030:

-

Long-Term Defence Modernisation Plans

India’s and other nations’ long-term plans to modernise their defence systems will keep demand high for Zen’s advanced training and simulation solutions. -

Global Expansion Strategy

Zen Technologies is actively looking to expand in international markets, which can significantly boost revenues by 2030. -

Technological Advancements

Continuous development in technologies like AI-based simulations, anti-drone systems, and smart warfare solutions can enhance Zen’s product portfolio. -

Increased Focus on Homeland Security

Rising internal security concerns worldwide may lead to higher spending on surveillance and simulation systems, directly benefiting Zen. -

Government Support for Domestic Defence Manufacturing

Policies supporting self-reliance (Atmanirbhar Bharat) in defence production will likely give Zen an edge over foreign competitors. -

Recurring Revenue from Maintenance Contracts

As Zen sells more systems, after-sales services and maintenance contracts will ensure stable, recurring income over the years. -

Strong R&D Investment

Zen’s commitment to investing in research and development will keep it ahead of the curve in a fast-evolving defence tech landscape. -

Geopolitical Tensions and Defence Budget Growth

Increasing global geopolitical tensions may lead to a rise in defence budgets worldwide, opening new opportunities for Zen Technologies.

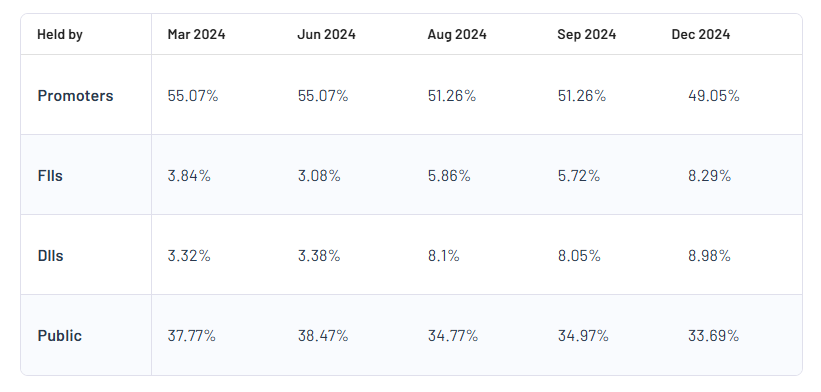

Zen Technologies Shareholding Pattern

| Promoters | 49.05% |

| FII | 8.29% |

| DII | 8.98% |

| Public | 33.69% |

Read Also:- Zydus Share Price Target 2025 To 2030- Current Chart, Market Overview