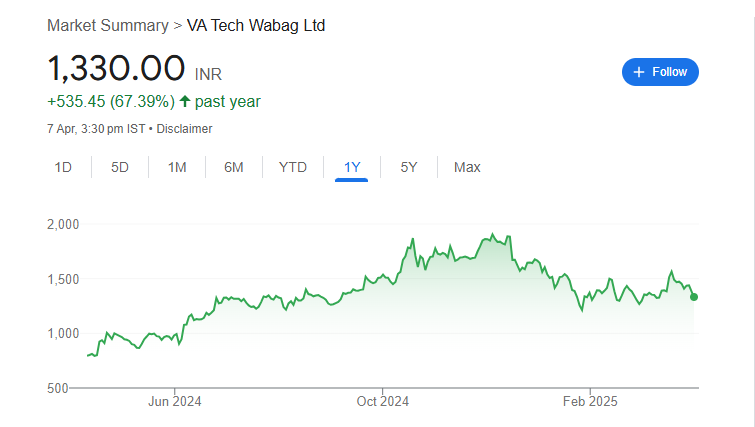

Va Tech Wabag Share Price Target 2025 To 2030- Current Chart, Market Overview

Va Tech Wabag is a leading company in the field of water treatment and management. With its headquarters in Chennai, India, the company provides advanced solutions for water purification, wastewater treatment, and water recycling. Va Tech Wabag works with industries and governments worldwide to ensure clean and safe water for communities and businesses. Va Tech Wabag Share Price on NSE as of 7 April 2025 is 1,330.00 INR.

Va Tech Wabag Share Price Chart

Va Tech Wabag Market Overview

- Open: 1,140.05

- High: 1,339.00

- Low: 1,140.05

- Previous Close: 1,384.35

- Volume: 668,369

- Value (Lacs): 8,854.22

- VWAP: 1,278.53

- UC Limit: 1,661.20

- LC Limit: 1,107.50

- 52 Week High: 1,944.00

- 52 Week Low: 765.50

- Mkt Cap (Rs. Cr.): 8,238

- Face Value: 2

Va Tech Wabag Share Price Target 2025 To 2030

| Va Tech Wabag Share Price Target Years | Va Tech Wabag Share Price |

| 2025 | ₹1950 |

| 2026 | ₹2500 |

| 2027 | ₹3000 |

| 2028 | ₹3500 |

| 2029 | ₹4000 |

| 2030 | ₹4500 |

Va Tech Wabag Share Price Target 2025

Va Tech Wabag share price target 2025 Expected target could be ₹1950. Here are 8 key factors affecting the growth of Va Tech Wabag share price target for 2025:

-

Government Focus on Water Infrastructure

Increased government spending on water treatment, wastewater management, and sanitation projects will positively impact the company’s growth. -

Urbanisation and Industrial Growth

Rapid urbanisation and industrial expansion in India and globally are driving demand for advanced water solutions, benefiting Va Tech Wabag. -

International Projects and Exports

Success in securing international contracts, especially in water-scarce regions, can boost revenue and expand the company’s global footprint. -

Technological Advancements

Adoption of innovative and energy-efficient water treatment technologies can strengthen the company’s competitive position. -

Sustainability and ESG Initiatives

Increasing focus on environmental, social, and governance (ESG) practices is encouraging more investments in water management companies like Wabag. -

Order Book Growth

A healthy and growing order book ensures strong revenue visibility for the future, which positively influences investor sentiment. -

Raw Material and Operational Costs

Fluctuations in raw material prices and operating expenses can impact margins, which in turn affects share price performance. -

Partnerships and Strategic Alliances

Collaborations with global technology providers and engineering firms can open new market opportunities and accelerate growth.

Va Tech Wabag Share Price Target 2030

Va Tech Wabag share price target 2030 Expected target could be ₹4500. Here are 8 key factors affecting the growth of Va Tech Wabag share price target for 2030:

-

Global Water Scarcity and Demand

With rising water scarcity issues worldwide, the demand for sustainable water management solutions is expected to grow significantly, benefiting Va Tech Wabag. -

Expansion into New Geographies

Entering emerging markets in Asia, Africa, and the Middle East can drive long-term revenue growth and reduce dependence on domestic markets. -

Climate Change and Environmental Regulations

Stricter environmental norms and climate policies globally will push industries and governments to invest more in water treatment solutions. -

Innovation in Water Recycling and Reuse Technologies

Advancements in water recycling, desalination, and zero-liquid discharge technologies can give Wabag a competitive edge. -

Strategic Partnerships and Acquisitions

Collaborations and potential acquisitions can accelerate growth, open new revenue streams, and enhance technical capabilities. -

Sustainable and Green Financing

Access to green bonds and sustainability-linked financing options will support large-scale projects and improve the financial position. -

Strong Order Backlog and Execution Efficiency

A robust order book with efficient execution of projects can sustain revenue growth and profitability over the long term. -

Macroeconomic Stability and Policy Support

Supportive government policies, stable interest rates, and favourable economic conditions will be crucial for growth by 2030.

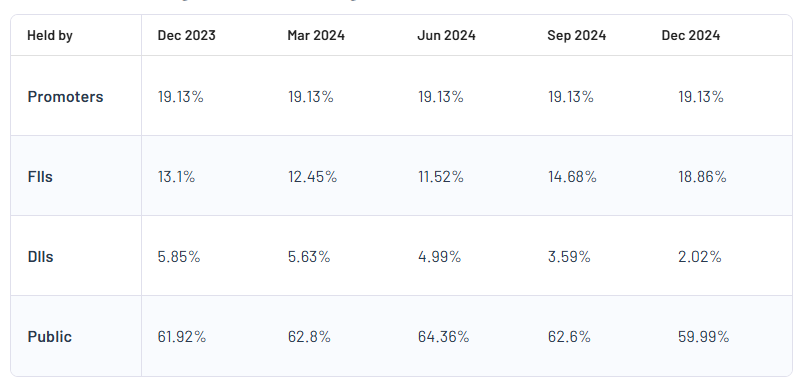

Va Tech Wabag Shareholding Pattern

| Promoters | 19.13% |

| FII | 18.86% |

| DII | 2.02% |

| Public | 59.99% |

Read Also:- Taylormade Renewables Share Price Target 2025 To 2030- Current Chart, Market Overview