Urban Enviro Share Price Target 2025 To 2030- Current Chart, Market Overview

Urban Enviro Waste Management is a company dedicated to providing efficient and sustainable waste management solutions. It plays a key role in keeping cities clean by offering services like waste collection, recycling, and disposal in an eco-friendly manner. Urban Enviro Share Price on NSE as of 4 April 2025 is 591.80 INR.

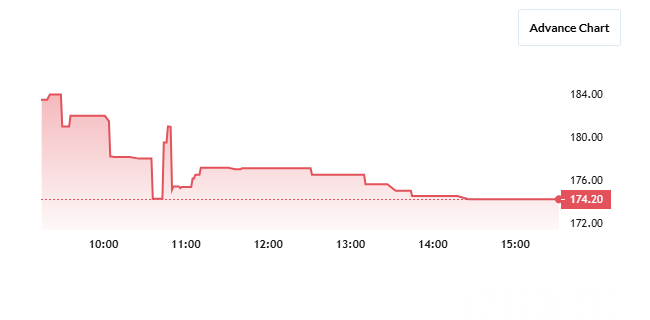

Urban Enviro Share Price Chart

Urban Enviro Market Overview

- Open: 184.00

- High: 184.00

- Low: 174.20

- Previous Close: 183.35

- Volume: 73,600

- Value (Lacs): 128.21

- VWAP: 176.85

- UC Limit: 192.50

- LC Limit: 174.20

- 52 Week High: 347.58

- 52 Week Low: 136.05

- Mkt Cap (Rs. Cr.): 75

- Face Value: 10

Urban Enviro Share Price Target 2025 To 2030

| Urban Enviro Share Price Target Years | Urban Enviro Share Price |

| 2025 | ₹350 |

| 2026 | ₹450 |

| 2027 | ₹550 |

| 2028 | ₹650 |

| 2029 | ₹750 |

| 2030 | ₹850 |

Urban Enviro Share Price Target 2025

Urban Enviro share price target 2025 Expected target could be ₹350. Here are 8 key factors that could influence the growth of Urban Enviro Waste Management’s share price by 2025:

-

Expansion of Project Portfolio: Growing the number of waste management projects can enhance revenue streams and market presence.

-

Government Regulations and Policies: Supportive environmental regulations and waste management policies can create favorable operating conditions.

-

Technological Advancements: Investing in modern waste processing technologies can improve efficiency and service quality.

-

Public Awareness and Demand: Increasing public concern for environmental sustainability can drive demand for professional waste management services.

-

Financial Performance: Maintaining strong financial health, including revenue growth and profitability, can boost investor confidence. The company has shown an annual revenue growth of 161%, with a healthy pre-tax margin of 10% and an exceptional return on equity of 32%.

-

Competitive Landscape: Effectively differentiating services in a competitive market can influence market share and profitability.

-

Infrastructure Development: Expansion into new regions and establishing necessary infrastructure can support growth objectives.

-

Debt Management: Prudent management of debt levels is crucial for financial stability. The company has a debt-to-equity ratio of 93%, indicating a higher reliance on debt financing.

Urban Enviro Share Price Target 2030

Urban Enviro share price target 2030 Expected target could be ₹850. Here are 8 key factors that could influence the growth of Urban Enviro Waste Management’s share price by 2030:

-

Expansion of Operations – Increasing the company’s presence in multiple cities and regions across India can lead to higher revenue and market dominance.

-

Government Regulations & Policies – Stricter environmental policies and government incentives for waste management companies can create growth opportunities.

-

Sustainable Waste Management Solutions – Adoption of advanced recycling, waste-to-energy, and sustainable disposal techniques can enhance operational efficiency and profitability.

-

Public & Corporate Awareness – Growing environmental consciousness among individuals and businesses can increase demand for professional waste management services.

-

Technological Innovations – Investments in automation, AI-based waste sorting, and smart waste management solutions can improve service delivery and cost efficiency.

-

Financial Strength & Debt Management – Maintaining a strong balance sheet, reducing debt levels, and ensuring consistent profit growth will attract investors.

-

Competitive Landscape – The company’s ability to stay ahead of competitors through service differentiation and strategic partnerships will impact its long-term growth.

-

Global Expansion Potential – Exploring international markets for waste management services, especially in developing economies, can unlock new revenue streams.

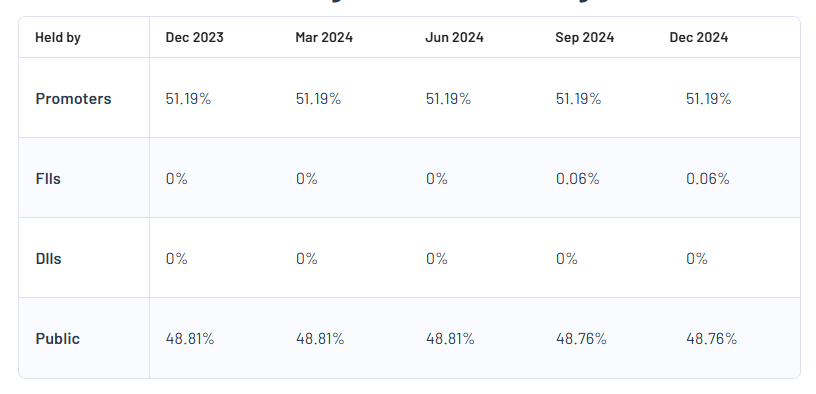

Urban Enviro Shareholding Pattern

| Promoters | 51.19% |

| FII | 0.06% |

| DII | 0% |

| Public | 48.76% |

Read Also:- Adani Total Gas Share Price Target 2025 To 2030- Current Chart, Market Overview