Taylormade Renewables Share Price Target 2025 To 2030- Current Chart, Market Overview

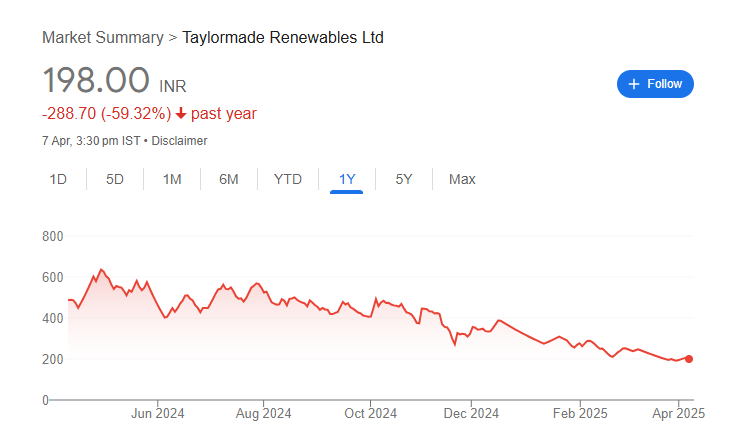

Taylormade Renewables is an Indian company focused on providing eco-friendly and sustainable energy solutions. They specialise in renewable technologies like solar dryers, solar desalination systems, and waste heat recovery systems, helping both industries and communities reduce their dependence on conventional energy sources. Taylormade Renewables Share Price on NSE as of 7 April 2025 is 198.00 INR.

Taylormade Renewables Share Price Chart

Taylormade Renewables Market Overview

- Open: 196.80

- High: 206.95

- Low: 196.80

- Previous Close: 207.15

- Volume: 19,271

- Value (Lacs): 38.16

- VWAP: 197.39

- UC Limit: 207.25

- LC Limit: 187.55

- 52 Week High: 658.70

- 52 Week Low: 191.45

- Mkt Cap (Rs. Cr.): 219

- Face Value: 10

Taylormade Renewables Share Price Target 2025 To 2030

| Taylormade Renewables Share Price Target Years | Taylormade Renewables Share Price |

| 2025 | ₹660 |

| 2026 | ₹720 |

| 2027 | ₹780 |

| 2028 | ₹840 |

| 2029 | ₹900 |

| 2030 | ₹960 |

Taylormade Renewables Share Price Target 2025

Taylormade Renewables share price target 2025 Expected target could be ₹660. Here are 8 key factors affecting the growth of Taylormade Renewables share price target for 2025:

-

Growing Demand for Clean Energy

As more people and businesses shift towards clean and green energy, Taylormade Renewables can benefit from higher demand for their products and services. -

Government Policies and Support

Supportive government schemes, subsidies, and renewable energy targets in India can help the company grow faster by reducing costs and increasing adoption. -

Expansion of Product Portfolio

If Taylormade Renewables introduces new and innovative products, it could attract more customers and open up new revenue streams. -

Partnerships and Collaborations

Collaborating with other companies and organisations can strengthen their market position and bring in more business opportunities. -

Technological Advancements

Adopting advanced technology can help improve efficiency, reduce costs, and deliver better solutions to clients. -

Competitive Market Scenario

The level of competition in the renewable energy sector will impact their growth; staying ahead with quality and innovation is crucial. -

Global Expansion Opportunities

If the company expands its presence beyond India, especially in markets that are focusing on renewable energy, it can see strong growth. -

Financial Health and Investments

Strong financial management and fresh investments can help the company scale operations and meet growing market demand.

Taylormade Renewables Share Price Target 2030

Taylormade Renewables share price target 2030 Expected target could be ₹960. Here are 8 key factors affecting the growth of Taylormade Renewables share price target for 2030:

-

Long-Term Focus on Sustainability

As the world becomes more serious about fighting climate change, the demand for renewable energy solutions like those offered by Taylormade Renewables is expected to grow steadily. -

Global Renewable Energy Goals

With many countries setting ambitious clean energy targets for 2030, Taylormade Renewables has the opportunity to expand its reach and tap into global markets. -

Innovation and R&D Investment

Continued investment in research and development can help the company introduce advanced products that meet future energy needs efficiently. -

Government Support and Incentives

Policies promoting solar, wind, and renewable technologies will likely continue, offering subsidies and tax benefits that can boost the company’s profitability. -

Climate Awareness and Consumer Demand

Increasing awareness among consumers and businesses to adopt eco-friendly energy solutions will create more market opportunities. -

Export Opportunities and International Growth

By exporting their renewable energy solutions, Taylormade Renewables can increase revenues and become a well-recognised global player. -

Strong Partnerships and Collaborations

Building strong ties with industries, governments, and global organisations can open new avenues for growth and stability. -

Financial Growth and Operational Efficiency

Maintaining healthy finances and improving operational efficiency will help the company scale up production and meet future demands effectively.

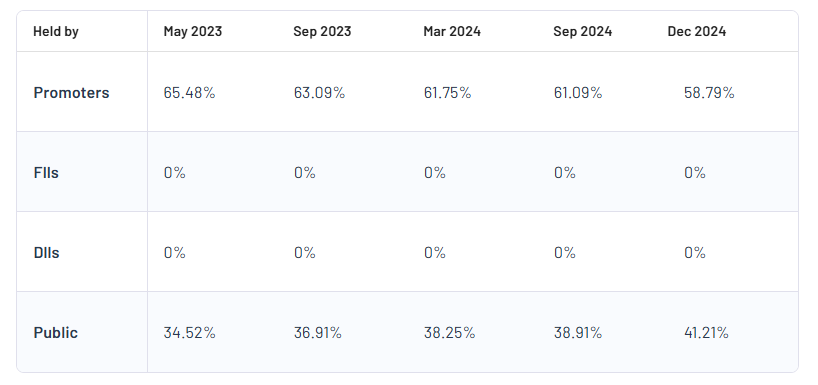

Taylormade Renewables Shareholding Pattern

| Promoters | 58.79% |

| FII | 0% |

| DII | 0% |

| Public | 41.21% |

Read Also:- Tamboli Industries Share Price Target 2025 To 2030- Current Chart, Market Overview