Swaraj Engines Share Price Target 2025 To 2030- Current Chart, Market Overview

Swaraj Engines is a well-known company in India that makes powerful and reliable diesel engines, mainly for tractors and other agricultural equipment. The company plays an important role in supporting farmers by providing engines that help improve farming productivity. Swaraj Engines Share Price on NSE as of 9 April 2025 is 3,854.00 INR.

Swaraj Engines Share Price Chart

Swaraj Engines Market Overview

- Open: 3,734.55

- High: 3,895.00

- Low: 3,734.55

- Previous Close: 3,662.35

- Volume: 8,938

- Value (Lacs): 343.59

- UC Limit: 0.00

- LC Limit: 0.00

- 52 Week High: 4,200.05

- 52 Week Low: 1,757.60

- Mkt Cap (Rs. Cr.): 4,669

- Face Value: 10

Swaraj Engines Share Price Target 2025 To 2030

| Swaraj Engines Share Price Target Years | Swaraj Engines Share Price |

| 2025 | ₹4200 |

| 2026 | ₹5500 |

| 2027 | ₹7000 |

| 2028 | ₹8500 |

| 2029 | ₹10,000 |

| 2030 | ₹11,500 |

Swaraj Engines Share Price Target 2025

Swaraj Engines share price target 2025 Expected target could be ₹4200. Here are 8 key factors affecting the growth of Swaraj Engines share price target for 2025:

-

Agricultural Demand

As Swaraj Engines primarily serves the tractor and farm equipment sector, any rise in agricultural demand will directly boost engine sales and revenue growth. -

Monsoon and Weather Conditions

Good monsoons increase agricultural activities, leading to higher tractor demand, which positively impacts Swaraj Engines’ sales. -

Government Policies & Subsidies

Supportive government schemes for farmers and rural development programs can encourage more tractor purchases, helping the company grow. -

Expansion of Rural Infrastructure

Growth in rural roads, irrigation, and electrification improves farming efficiency, leading to greater demand for tractors and engines. -

Technological Advancements

Investment in advanced and fuel-efficient engine technologies can give Swaraj Engines a competitive edge in the market. -

Export Opportunities

Expanding into international markets, especially in agriculture-driven countries, can open new revenue streams for the company. -

Cost Management & Raw Material Prices

Effective control over production costs and fluctuations in raw material prices like steel and metals will impact profitability. -

Partnership with Mahindra Group

Since Swaraj Engines is a part of the Mahindra Group, strong synergy and rising demand from Mahindra Tractors will continue to drive its growth.

Swaraj Engines Share Price Target 2030

Swaraj Engines share price target 2030 Expected target could be ₹11,500. Here are 8 key factors affecting the growth of Swaraj Engines share price target for 2030:

-

Long-term Rural Development

Continued improvements in rural infrastructure, farming technology, and mechanization will sustain long-term demand for tractors and engines. -

Shift Towards Sustainable Farming

As farmers adopt eco-friendly practices, demand for fuel-efficient and low-emission engines will rise, benefiting companies like Swaraj Engines. -

Global Expansion and Exports

Increasing focus on exports to developing nations with growing agricultural sectors can significantly boost revenues. -

Technological Innovation

Development of next-generation engines with better performance, lower emissions, and smart features will help maintain market leadership. -

Economic Growth and Farm Incomes

Rising farmer incomes and overall economic growth will encourage investment in better farming equipment, supporting engine sales. -

Government Initiatives for Modern Farming

Long-term policies promoting modernization of agriculture will create a favorable environment for Swaraj Engines’ growth. -

Strategic Partnerships and Collaborations

Collaborating with OEMs and tech companies for innovative solutions can open new business opportunities. -

Raw Material Price Stability

Efficient management of raw material sourcing and price volatility will be crucial in maintaining healthy profit margins by 2030.

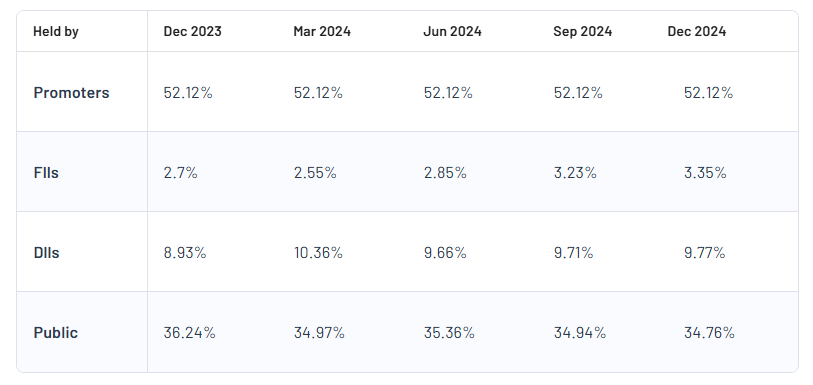

Swaraj Engines Shareholding Pattern

| Promoters | 52.12% |

| FII | 3.35% |

| DII | 9.77% |

| Public | 34.76% |

Read Also:- Igarashi Motors Share Price Target 2025 To 2030- Current Chart, Market Overview