Stallion India Share Price Target 2025 To 2030- Current Chart, Market Overview

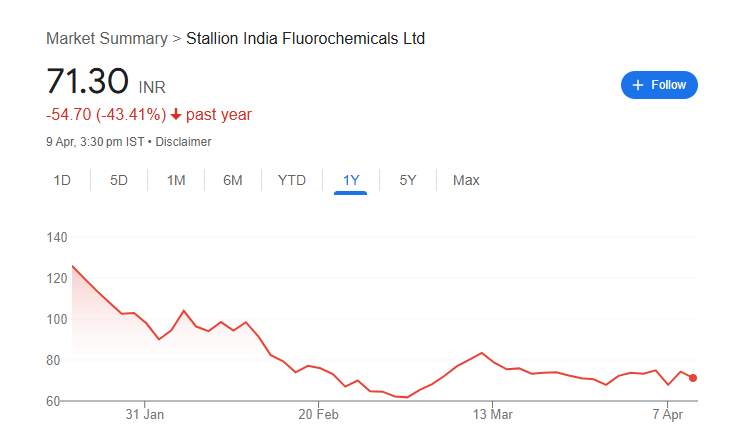

Stallion India is a growing company that offers solutions in the field of packaging, automation, and industrial equipment. Known for its focus on quality and customer satisfaction, the company provides a wide range of products that support various industries such as manufacturing, logistics, and infrastructure. Stallion India is continuously working on improving its technology and expanding its services to meet the changing needs of the market. Stallion India Share Price on NSE as of 11 April 2025 is 71.30 INR.

Stallion India Share Price Chart

Stallion India Market Overview

- Open: 73.55

- High: 73.95

- Low: 71.01

- Previous Close: 74.33

- Volume: 437,996.00

- Value (Lacs): 312.42

- UC Limit: 0.00

- LC Limit: 0.00

- 52 Week High: 126.00

- 52 Week Low: 60.00

- Mkt Cap (Rs. Cr.): 566

- Face Value: 10.00

Stallion India Share Price Target 2025 To 2030

| Stallion India Share Price Target Years | Stallion India Share Price |

| 2025 | ₹125 |

| 2026 | ₹150 |

| 2027 | ₹175 |

| 2028 | ₹200 |

| 2029 | ₹225 |

| 2030 | ₹250 |

Stallion India Share Price Target 2025

Stallion India share price target 2025 Expected target could be ₹125. Here are 8 key factors affecting the growth of Stallion India for its share price target in 2025:

-

Expansion of Product Portfolio

If Stallion India expands its range of products and services, it can attract a wider customer base and boost revenue. -

Market Demand & Industry Growth

Growth in the sectors Stallion India serves, like engineering or industrial services, will directly influence its business performance. -

Government Policies & Infrastructure Push

Supportive government policies and increased spending on infrastructure projects can benefit the company’s order book and profitability. -

Raw Material Costs & Supply Chain Management

Fluctuations in raw material prices and the efficiency of its supply chain can impact production costs and margins. -

Technological Advancements

Adoption of new technologies can improve efficiency, reduce costs, and enhance product quality, giving Stallion India a competitive edge. -

Export Opportunities

Exploring and expanding into international markets can open new revenue streams and reduce dependency on domestic demand. -

Economic Environment

A stable and growing economy will boost industrial demand, helping companies like Stallion India to grow their business. -

Strong Financial Health

Maintaining healthy financials, with good cash flow and controlled debt, will build investor confidence and support share price growth.

Stallion India Share Price Target 2030

Stallion India share price target 2030 Expected target could be ₹250. Here are 8 key factors affecting the growth of Stallion India for its share price target in 2030:

-

Long-Term Infrastructure Development

With India focusing on long-term infrastructure projects, Stallion India could benefit from steady contracts and demand over the decade. -

Global Expansion and Export Growth

Expanding to international markets and increasing exports can significantly boost the company’s revenue streams by 2030. -

Innovation and Technology Adoption

Continued investment in modern technologies and innovation will help improve efficiency, product quality, and competitiveness. -

Sustainability Initiatives

Embracing green technologies and sustainable practices can attract eco-conscious clients and align with global trends. -

Strategic Partnerships and Collaborations

Partnerships with bigger players or international firms can help Stallion India access new markets and expertise. -

Economic Cycles and Industrial Growth

The health of the economy and the industrial sector will directly impact Stallion India’s growth potential and profitability. -

Government Support and Policies

Pro-business government reforms and incentives for manufacturing and infrastructure sectors will be crucial for long-term growth. -

Strong Leadership and Vision

A forward-thinking management team and clear strategic direction will help Stallion India navigate market challenges and seize growth opportunities by 2030.

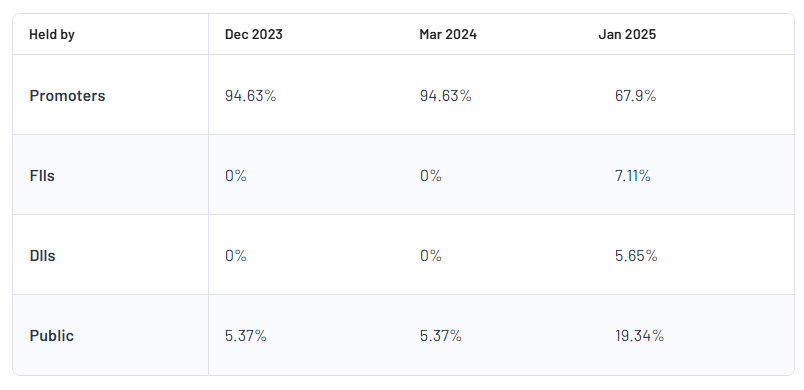

Stallion India Shareholding Pattern

| Promoters | 67.9% |

| FII | 7.11% |

| DII | 5.65% |

| Public | 19.34% |

Read Also:- Denta Water and Infra Solutions Share Price Target 2025 To 2030- Current Chart, Market Overview