Radico Khaitan Share Price Target 2025 To 2030- Current Chart, Market Overview

Radico Khaitan is one of India’s leading liquor companies, known for making a wide range of popular alcoholic beverages. Established many years ago, the company has built a strong reputation with its famous brands like Magic Moments vodka, 8 PM whisky, and Morpheus brandy. Radico focuses on offering quality products at different price points, making them accessible to many customers. Radico Khaitan Share Price on NSE as of 9 April 2025 is 2,328.00 INR.

Radico Khaitan Share Price Chart

Radico Khaitan Market Overview

- Open: 2,248.15

- High: 2,349.00

- Low: 2,248.15

- Previous Close: 2,248.00

- Volume: 211,830

- Value (Lacs): 4,921.45

- UC Limit: 0.00

- LC Limit: 0.00

- 52 Week High: 2,637.70

- 52 Week Low: 1,429.85

- Mkt Cap (Rs. Cr.): 31,087

- Face Value: 2

Radico Khaitan Share Price Target 2025 To 2030

| Radico Khaitan Share Price Target Years | Radico Khaitan Share Price |

| 2025 | ₹2640 |

| 2026 | ₹3450 |

| 2027 | ₹4000 |

| 2028 | ₹4600 |

| 2029 | ₹5100 |

| 2030 | ₹5700 |

Radico Khaitan Share Price Target 2025

Radico Khaitan share price target 2025 Expected target could be ₹2640. Here are 8 key factors that could affect the growth of Radico Khaitan’s share price target for 2025:

-

Premium Product Portfolio Expansion

Radico Khaitan’s growth depends on expanding its premium and luxury segment, which offers higher margins and growing consumer interest. -

Rural and Urban Market Penetration

Stronger distribution networks in both rural and urban areas can help increase sales and market share. -

Government Policies and Regulations

Changes in excise duties, alcohol bans in certain states, or new regulations on liquor sales can directly impact revenue and profitability. -

Raw Material Costs

Fluctuation in prices of key raw materials like grains and packaging materials can affect the company’s margins. -

Export Opportunities

Increasing focus on exports and entry into new international markets can support revenue growth and brand recognition. -

Brand Recognition and Marketing

Effective branding, marketing campaigns, and celebrity endorsements can enhance customer loyalty and attract new buyers. -

Consumer Preferences and Lifestyle Changes

Growing acceptance of alcoholic beverages among younger consumers and changing lifestyle trends support demand growth. -

Competition in the Industry

Competition from both domestic and international players can influence pricing strategies and market share.

Radico Khaitan Share Price Target 2030

Radico Khaitan share price target 2030 Expected target could be ₹5700. Here are 8 key factors that could influence the growth of Radico Khaitan’s share price target for 2030:

-

Global Expansion Strategy

If Radico Khaitan continues to expand into international markets, especially premium segments, it can unlock new revenue streams and boost long-term growth. -

Premiumization Trend

Growing consumer preference for premium and craft spirits globally and in India can significantly benefit Radico’s premium offerings. -

Sustainable Practices and ESG Focus

Increasing focus on sustainability, responsible sourcing, and eco-friendly packaging could enhance brand value and attract ethical investors. -

Technological Advancements

Adoption of automation, digital marketing, and advanced manufacturing techniques can improve operational efficiency and reduce costs. -

Diversification of Product Portfolio

Introducing new varieties, flavors, and categories of alcoholic beverages can capture diverse consumer preferences. -

Policy Reforms and Liberalization

Positive changes in liquor licensing policies and distribution reforms by the government can create a favorable business environment. -

Consumer Demographic Shifts

India’s young and growing middle-class population will likely increase demand for branded alcoholic beverages. -

Strong Financial Health

Maintaining healthy financials, low debt levels, and steady profit growth can increase investor confidence and positively impact share prices.

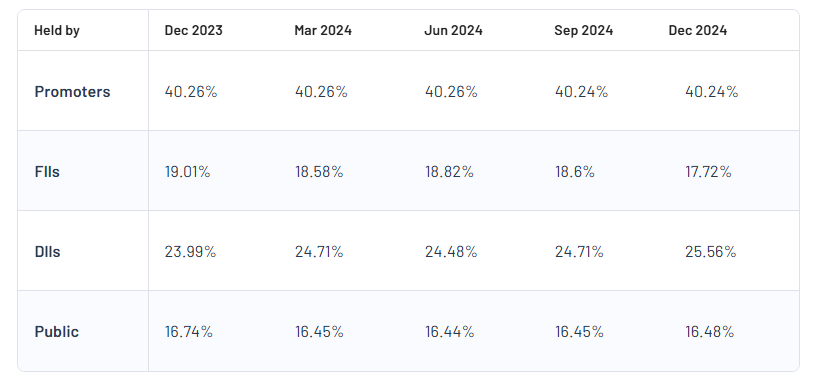

Radico Khaitan Shareholding Pattern

| Promoters | 40.24% |

| FII | 17.72% |

| DII | 25.56% |

| Public | 16.48% |

Read Also:- OM Infra Share Price Target 2025 To 2030- Current Chart, Market Overview