PG Share Price Target 2025 To 2030- Current Chart, Market Overview

Procter & Gamble (P&G) is a well-known global company that makes everyday household and personal care products. Founded in 1837, P&G owns popular brands like Pampers, Tide, Gillette, Pantene, and Olay, which are used by millions of people worldwide. The company focuses on innovation, quality, and sustainability to meet the changing needs of consumers. P&G has a strong presence in markets across the world, continuously improving its products with advanced technology and research. PG Share Price on NSE as of 1 April 2025 is 170.42 USD.

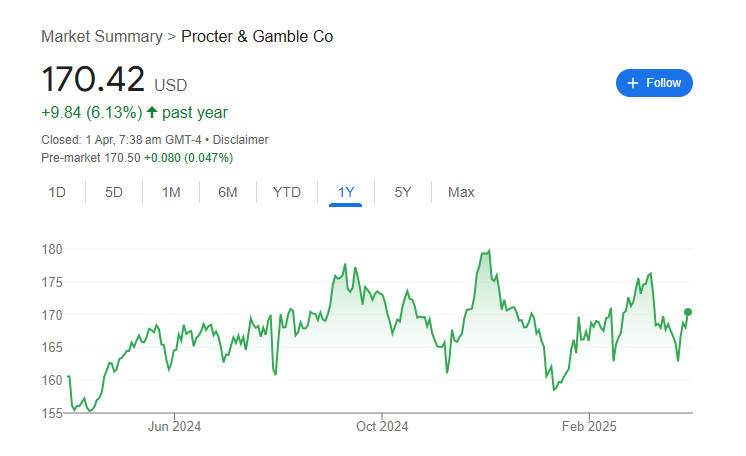

PG Share Price Chart

PG Market Overview

- Open: 13,601.00

- High: 13,900.00

- Low: 13,451.30

- Previous Close: 13,600.65

- Volume: 9,731

- Value (Lacs): 1,322.20

- VWAP: 13,645.71

- UC Limit: 16,320.75

- LC Limit: 10,880.55

- 52 Week High: 17,745.00

- 52 Week Low: 12,105.60

- Mkt Cap (Rs. Cr.): 44,106

- Face Value: 10

PG Share Price Target 2025 To 2030

| PG Share Price Target Years | PG Share Price |

| 2025 | $182 |

| 2026 | $200 |

| 2027 | $220 |

| 2028 | $240 |

| 2029 | $260 |

| 2030 | $280 |

PG Share Price Target 2025

PG share price target 2025 Expected target could be $182. Procter & Gamble Co. (PG) is a leading global consumer goods company known for its diverse portfolio of brands. Here are eight key factors that could influence the growth of PG’s share price by 2025:

-

Product Innovation and Brand Strength: Continuous development of new products and maintaining strong brand recognition are crucial for sustaining consumer interest and driving sales growth.

-

Market Expansion: Entering new geographic markets and increasing market share in existing regions can contribute to revenue growth.

-

Cost Management and Efficiency: Effective control of production and operational costs can enhance profit margins, positively impacting earnings.

-

Consumer Spending Trends: Changes in consumer behavior and spending patterns, influenced by economic conditions, can affect demand for PG’s products.

-

Competitive Landscape: The company’s ability to compete with other consumer goods firms in terms of pricing, quality, and innovation will influence its market position.

-

Regulatory Environment: Compliance with regulations and policies in different markets can impact operations and profitability.

-

Raw Material Costs: Fluctuations in the prices of raw materials used in production can affect cost structures and margins.

-

Currency Exchange Rates: As a global company, PG’s earnings are subject to currency exchange rate fluctuations, which can impact financial performance.

PG Share Price Target 2030

PG share price target 2030 Expected target could be $280. Here are eight key factors that could influence the growth of Procter & Gamble (PG) share price by 2030:

-

Long-Term Consumer Demand – As a global consumer goods company, PG’s growth will depend on sustained demand for its products across categories like home care, personal care, and health.

-

Technological Advancements – Adoption of AI, automation, and digital marketing strategies can improve efficiency, customer engagement, and profitability.

-

Sustainability Initiatives – Increasing focus on eco-friendly packaging, sustainable sourcing, and carbon footprint reduction can enhance brand reputation and attract socially responsible investors.

-

Emerging Market Growth – Expanding presence in high-growth regions such as Asia, Africa, and Latin America can significantly boost revenue.

-

Mergers & Acquisitions – Strategic acquisitions of innovative brands or partnerships with tech-driven companies can enhance PG’s product portfolio and competitiveness.

-

Macroeconomic Conditions – Inflation, interest rates, and global economic stability will influence consumer purchasing power and PG’s overall growth.

-

Dividend and Share Buyback Policies – Consistent dividend payouts and stock repurchase programs can increase investor confidence and support long-term share price growth.

-

Regulatory and Geopolitical Factors – Compliance with evolving global trade policies, taxation laws, and political stability will play a crucial role in PG’s operational success.

Read Also:- GMR Power Share Price Target 2025 To 2030- Current Chart, Market Overview