PCBL Share Price Target 2025 To 2030- Current Chart, Market Overview

PCBL, which stands for Phillips Carbon Black Limited, is one of India’s leading manufacturers of carbon black, an important material used mainly in tyres, plastics, and paints. Founded by the RP-Sanjiv Goenka Group, PCBL has grown into a trusted name in the chemical industry, not just in India but globally. The company focuses on producing high-quality carbon black and is also making efforts to create more eco-friendly and sustainable products. PCBL Price on NSE as of 10 April 2025 is 399.50 INR.

PCBL Price Chart

PCBL Market Overview

- Open: 400.00

- High: 409.50

- Low: 392.10

- Previous Close: 401.00

- Volume: 1,630,502

- Value (Lacs): 6,491.84

- VWAP: 399.34

- UC Limit: 481.20

- LC Limit: 320.80

- 52 Week High: 584.40

- 52 Week Low: 209.00

- Mkt Cap (Rs. Cr.): 15,028

- Face Value: 1

PCBL Price Target 2025 To 2030

| PCBL Price Target Years | PCBL Price |

| 2025 | ₹590 |

| 2026 | ₹750 |

| 2027 | ₹900 |

| 2028 | ₹1050 |

| 2029 | ₹1200 |

| 2030 | ₹1350 |

PCBL Price Target 2025

PCBL share price target 2025 Expected target could be ₹590. Here are 8 key factors affecting the growth of PCBL (Phillips Carbon Black Limited) for its share price target in 2025:

-

Rising Demand in Tyre Industry

Since carbon black is a key raw material in tyre manufacturing, increasing vehicle sales and replacement demand will directly boost PCBL’s growth. -

Expansion Plans

PCBL is actively expanding its manufacturing capacity, both in India and abroad, which can significantly increase production and revenue potential. -

Diversification of Product Portfolio

The company is focusing on specialty carbon black products used in plastics, inks, and coatings, which generally offer higher margins. -

Global Market Opportunities

As PCBL exports to multiple countries, a favourable global demand environment can open new markets and increase foreign revenue. -

Raw Material Price Fluctuations

Carbon black production depends on feedstock derived from crude oil; volatility in crude prices can impact margins and profitability. -

Environmental Regulations

Stricter environmental norms could increase operating costs, but PCBL’s investments in sustainable technology may give it an edge. -

Technological Advancements

Adoption of cleaner and more efficient production technologies can help PCBL reduce costs and meet global quality standards. -

Economic Growth and Infrastructure Development

Higher economic activity and investments in infrastructure increase demand for automotive and industrial applications, benefiting PCBL.

PCBL Price Target 2030

PCBL share price target 2030 Expected target could be ₹1350. Here are 8 key factors affecting the growth of PCBL (Phillips Carbon Black Limited) for its share price target by 2030:

-

Long-Term Auto Industry Growth

With the expected increase in global and domestic automotive production, especially electric vehicles, the demand for tyres and hence carbon black will continue to rise. -

Expansion in Specialty Carbon Black Segment

By 2030, PCBL aims to strengthen its position in the high-margin specialty black segment used in plastics, coatings, and electronics, boosting profitability. -

Global Market Penetration

Deeper entry into international markets and establishing global partnerships will diversify revenue streams and reduce dependency on domestic demand. -

Focus on Sustainability and Green Manufacturing

PCBL’s efforts toward sustainable and energy-efficient production will align with global environmental goals, attracting ESG-conscious investors. -

Technological Innovations

Continued investment in R&D for advanced carbon black grades and efficient production technologies will keep PCBL competitive worldwide. -

Government Policies and Infrastructure Push

Ongoing government initiatives for infrastructure development and “Make in India” will indirectly support industries using carbon black. -

Volatility in Crude Oil Prices

Feedstock costs remain a critical factor. Efficient sourcing and alternate feedstock strategies will help PCBL manage cost pressures. -

Strategic Capacity Expansion

With strategic plans to expand manufacturing capacity, PCBL can meet growing demand while enjoying economies of scale and improved margins.

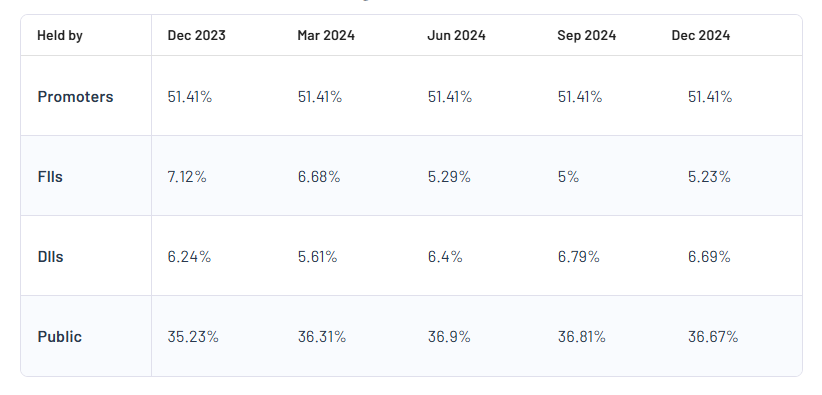

PCBL Shareholding Pattern

| Promoters | 51.41% |

| FII | 5.23% |

| DII | 6.69% |

| Public | 36.67% |

Read Also:- Zen Technologies Share Price Target 2025 To 2030- Current Chart, Market Overview