Paytm Share Price Target 2025 To 2030- Current Chart, Market Overview

Paytm is a well-known Indian fintech company that offers a range of digital services, including mobile payments, money transfers, and financial products. Founded in 2010, it started as a platform for online recharge and bill payments but quickly expanded to offer services like Paytm Wallet, Paytm Bank, and insurance. It has become one of India’s leading digital payment platforms, allowing users to pay for goods and services online, transfer money, and even invest in stocks. Paytm Share Price on NSE as of 1 April 2025 is 801.35 INR.

Paytm Share Price Chart

Paytm Market Overview

- Open: 780.00

- High: 806.00

- Low: 772.00

- Previous Close: 783.45

- Volume: 4,796,902

- Value (Lacs): 38,427.98

- VWAP: 794.38

- UC Limit: 861.75

- LC Limit: 705.10

- 52 Week High: 1,062.95

- 52 Week Low: 310.00

- Mkt Cap (Rs. Cr.): 51,097

- Face Value: 1

Paytm Share Price Target 2025 To 2030

| Paytm Share Price Target Years | Paytm Share Price |

| 2025 | ₹1065 |

| 2026 | ₹1400 |

| 2027 | ₹1800 |

| 2028 | ₹2200 |

| 2029 | ₹2600 |

| 2030 | ₹3000 |

Paytm Share Price Target 2025

Paytm share price target 2025 Expected target could be ₹1065. Here are 8 key factors affecting the growth of Paytm’s share price target for 2025:

-

Expansion in Digital Payments: Paytm’s core business is digital payments. As the government and consumers increasingly adopt cashless payments, Paytm is well-positioned to benefit from this growth, particularly through its Paytm Wallet, UPI services, and QR code solutions.

-

E-commerce and Merchant Services Growth: Paytm has diversified into e-commerce and merchant services, helping businesses with payment processing and other digital services. Expansion in this area will likely contribute to its revenue growth.

-

Strong Financial Services Portfolio: Paytm has expanded into the financial services sector with offerings such as Paytm Money (investment platform), Paytm Insurance, and Paytm Bank. The growth in these segments will directly impact its overall valuation and stock price.

-

Regulatory Environment: Government regulations, especially in the fintech and payments space, can greatly impact Paytm’s operations. Any changes to regulations, such as data privacy laws or payment processing norms, will influence growth.

-

User Base Growth: Paytm’s large and expanding user base is crucial for its growth. The company’s ability to acquire and retain customers, especially in tier-2 and tier-3 cities, will determine the company’s revenue and profitability.

-

Competition in the Digital Payments Space: Paytm faces competition from other fintech companies like PhonePe, Google Pay, and traditional banks offering digital services. Its ability to innovate and maintain market leadership will be key for growth.

-

Partnerships and Strategic Alliances: Paytm’s alliances with banks, financial institutions, and other large companies are vital for enhancing its service offerings. Strategic partnerships, including the possibility of global expansion, can boost its growth prospects.

-

Technology and Innovation: Continuous investment in technology, including AI, machine learning, and blockchain, to improve payment systems, fraud detection, and personalized services will help Paytm stay ahead of the competition and drive long-term growth.

Paytm Share Price Target 2030

Paytm share price target 2030 Expected target could be ₹3000. Here are 8 key factors affecting the growth of Paytm’s share price target for 2030:

-

Market Leadership in Fintech: By 2030, Paytm’s leadership in the fintech space will be a key factor. As digital payments, mobile banking, and financial services continue to grow, Paytm’s established brand and infrastructure could help it maintain a strong position in India and potentially expand globally.

-

Diversification of Services: Over the next decade, Paytm’s ability to diversify its services further, including into areas such as lending, wealth management, and insurance, will significantly influence its growth and overall valuation.

-

Adoption of Digital Payments and Financial Inclusion: As India and other emerging markets continue to push for financial inclusion, Paytm’s role in driving digital payments and services for the unbanked population will be critical for its long-term growth.

-

International Expansion: Paytm’s success in expanding beyond India, particularly into other emerging markets or developed countries, will be a key determinant of its growth. The company’s ability to adapt its services to new markets and compete with global players is important.

-

Technological Advancements: Innovations in technology, such as AI, blockchain, and biometric-based payments, could transform Paytm’s services, making it more efficient and secure. This would enhance customer trust and adoption, directly influencing its growth.

-

Strategic Acquisitions and Partnerships: Paytm’s growth will depend on its ability to identify and capitalize on strategic acquisitions or partnerships, especially with global fintech companies or large financial institutions. Such alliances can help Paytm tap into new markets or customer segments.

-

Regulatory and Policy Changes: Government regulations will continue to play a major role in shaping the fintech industry. Any changes in taxation, data privacy laws, or payment processing regulations could either enhance or restrict Paytm’s growth prospects.

-

Economic Growth and Consumer Spending: Paytm’s performance will also depend on India’s overall economic growth. Rising disposable income, increasing consumer spending, and the continued shift towards a cashless economy will provide the foundation for Paytm’s growth in the coming years.

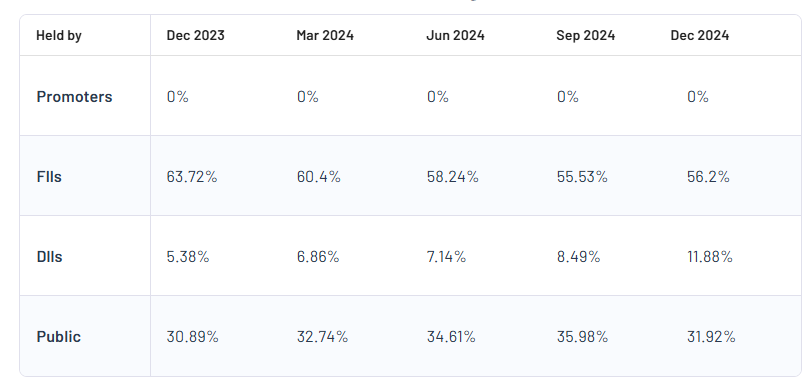

Paytm Shareholding Pattern

| Promoters | 0% |

| FII | 56.2% |

| DII | 11.88% |

| Public | 31.92% |

Read Also:- Natco Pharma Share Price Target 2025 To 2030- Current Chart, Market Overview