NIIT Share Price Target 2025 To 2030- Current Chart, Market Overview

NIIT is a leading global company specializing in education and training solutions. Founded in 1981, it has played a key role in shaping the IT and skills development industry. NIIT offers a wide range of learning programs, including corporate training, digital learning, and upskilling courses for professionals and students. The company has a strong presence in various countries, providing innovative training solutions to businesses, governments, and individuals. NIIT Share Price on NSE as of 4 April 2025 is 116.00 INR.

NIIT Share Price Chart

NIIT Market Overview

- Open: 124.20

- High: 124.75

- Low: 113.61

- Previous Close: 125.16

- Volume: 1,141,187

- Value (Lacs): 1,320.92

- VWAP: 117.73

- UC Limit: 150.19

- LC Limit: 100.12

- 52 Week High: 233.80

- 52 Week Low: 90.55

- Mkt Cap (Rs. Cr.): 1,569

- Face Value: 2

NIIT Share Price Target 2025 To 2030

| NIIT Share Price Target Years | NIIT Share Price |

| 2025 | ₹240 |

| 2026 | ₹260 |

| 2027 | ₹280 |

| 2028 | ₹300 |

| 2029 | ₹320 |

| 2030 | ₹340 |

NIIT Share Price Target 2025

NIIT share price target 2025 Expected target could be ₹240. Here are 8 Key Factors Affecting Growth for NIIT Share Price Target 2025:

-

Demand for Digital Learning – The rising need for online and tech-driven education solutions can boost NIIT’s growth.

-

Corporate Training Partnerships – Expanding collaborations with global companies for skill development will impact revenue.

-

Government Initiatives in Education – Policies supporting digital learning and skill development can benefit NIIT.

-

Adoption of Emerging Technologies – AI, data science, and cybersecurity training demand can drive business growth.

-

Financial Performance – Revenue growth, profitability, and cost efficiency will play a crucial role in share price movement.

-

Expansion into New Markets – Entering new geographies and industries will provide additional growth opportunities.

-

Competition in the EdTech Sector – Rising competition from other education technology companies may impact market share.

-

Global Economic Conditions – Economic slowdowns or fluctuations can affect corporate training budgets, influencing NIIT’s revenue.

NIIT Share Price Target 2030

NIIT share price target 2030 Expected target could be ₹340. Here are 8 Key Factors Affecting Growth for NIIT Share Price Target 2030:

-

Long-Term Growth in EdTech – The increasing shift towards digital and skill-based learning will continue to drive demand.

-

Global Expansion – Expanding operations in international markets will provide new revenue streams.

-

Strategic Acquisitions & Partnerships – Collaborations with universities and businesses can strengthen NIIT’s market position.

-

Advancements in AI & Automation – Adapting to AI-driven learning solutions can help NIIT stay ahead in the industry.

-

Government & Corporate Training Programs – Increased investment in workforce upskilling by governments and companies will boost demand.

-

Technological Innovations – Continuous updates in e-learning platforms and content will be key to staying competitive.

-

Financial Health & Profitability – Consistent revenue growth, cost control, and profitability will influence investor confidence.

-

Market Competition & Disruptions – The rise of new EdTech players and alternative learning models may pose challenges.

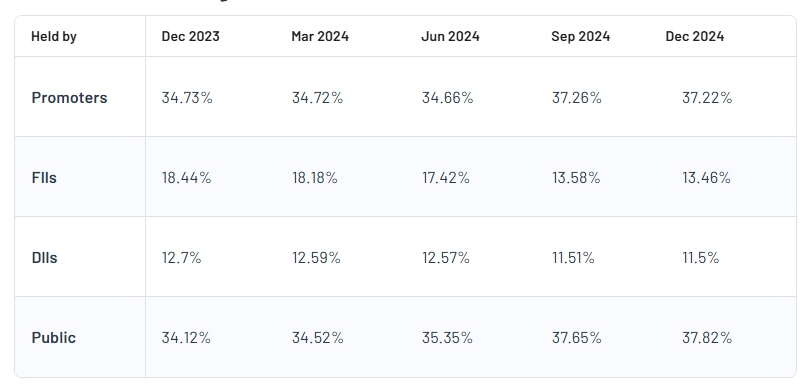

NIIT Shareholding Pattern

| Promoters | 37.22% |

| FII | 13.46% |

| DII | 11.5% |

| Public | 37.82% |

Read Also:- ACE Share Price Target 2025 To 2030- Current Chart, Market Overview