Natco Pharma Share Price Target 2025 To 2030- Current Chart, Market Overview

Natco Pharma is an Indian pharmaceutical company that has gained recognition for producing high-quality generic medicines, particularly in oncology, HIV/AIDS, and other therapeutic areas. The company is known for its strong research and development (R&D) capabilities, which allow it to develop cost-effective alternatives to expensive brand-name drugs. Natco Pharma has a significant presence in the global market, particularly in the United States, where it supplies affordable medicines. Natco Pharma Share Price on NSE as of 1 April 2025 is 804.85 INR.

Natco Pharma Share Price Chart

Natco Pharma Market Overview

- Open: 798.75

- High: 812.45

- Low: 797.00

- Previous Close: 798.75

- Volume: 587,872

- Value (Lacs): 4,732.08

- VWAP: 802.82

- UC Limit: 878.60

- LC Limit: 718.90

- 52 Week High: 1,639.00

- 52 Week Low: 757.05

- Mkt Cap (Rs. Cr.): 14,417

- Face Value: 2

Natco Pharma Share Price Target 2025 To 2030

| Natco Pharma Share Price Target Years | Natco Pharma Share Price |

| 2025 | ₹1640 |

| 2026 | ₹1750 |

| 2027 | ₹1800 |

| 2028 | ₹1850 |

| 2029 | ₹1900 |

| 2030 | ₹1950 |

Natco Pharma Share Price Target 2025

Natco Pharma share price target 2025 Expected target could be ₹1640. Here are 8 Key Factors Affecting Growth for Natco Pharma Share Price Target 2025:

-

New Drug Approvals – The success of Natco Pharma’s upcoming drug pipeline and regulatory approvals from agencies like the US FDA and DCGI will play a major role in driving its growth.

-

Generic Drug Market Expansion – The company’s ability to launch cost-effective generic versions of high-demand drugs will impact revenue and market position.

-

Domestic & Global Demand – Rising healthcare needs in India and increased export opportunities to the US, Europe, and emerging markets will influence the company’s growth.

-

Patent Challenges & Litigation – The outcome of patent disputes and litigation in key markets, especially in the US, can impact the availability of key drugs and overall financial performance.

-

Research & Development (R&D) Investment – Increased spending on R&D to develop innovative drugs and biosimilars will help the company sustain long-term growth.

-

Government Policies & Regulations – Any changes in Indian and global pharmaceutical regulations, including price controls, taxation, and licensing, can impact profitability.

-

Competition in the Pharma Sector – The presence of strong domestic and global competitors in the pharmaceutical industry may affect Natco Pharma’s pricing power and market share.

-

Economic & Market Conditions – Currency fluctuations, inflation, and overall stock market sentiment will also influence Natco Pharma’s share price movement in 2025.

Natco Pharma Share Price Target 2030

Natco Pharma share price target 2030 Expected target could be ₹1950. Here 8 Key Factors Affecting Growth for Natco Pharma Share Price Target 2030:

-

Diversification into New Markets – Expanding into emerging markets and strengthening its presence in developed markets like the US and Europe will be essential for Natco Pharma’s long-term growth.

-

Biosimilars and Specialty Drugs – Developing and launching biosimilars and specialty drugs, which have higher margins and limited competition, could significantly boost revenues over the next decade.

-

Strategic Acquisitions and Partnerships – Natco Pharma’s growth will depend on its ability to form strategic partnerships or acquisitions that help expand its product portfolio, improve R&D capabilities, and enter new markets.

-

Regulatory Approvals and Compliance – Success in navigating complex global regulatory environments, particularly for its novel therapies, will directly influence revenue growth and market expansion.

-

Sustained R&D Focus – Continued investment in R&D to develop new generics, specialized formulations, and novel therapies, especially in oncology and chronic diseases, will drive future growth.

-

Pricing and Cost Control – Managing production costs, raw material pricing, and maintaining competitive pricing while ensuring margins will be critical for sustaining profitability over the next decade.

-

Long-Term Partnerships with Global Pharma Giants – Collaborating with large pharmaceutical companies for product development, co-marketing, and distribution can provide growth opportunities and market access.

-

Global Healthcare Trends – Increased focus on affordable healthcare and rising demand for essential medicines globally, especially in aging populations and chronic diseases, will support Natco Pharma’s growth trajectory by 2030.

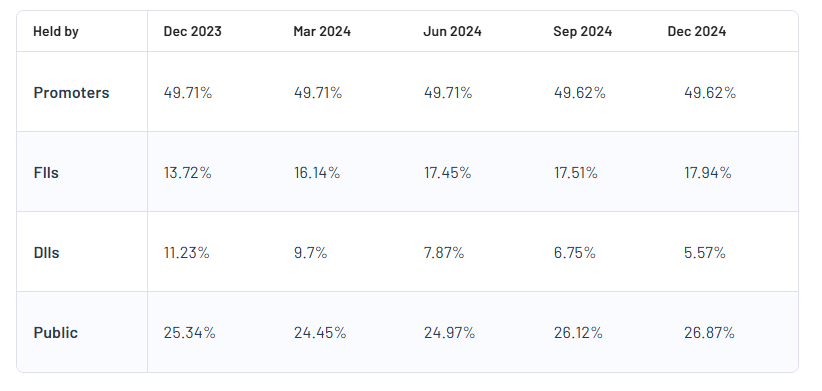

Natco Pharma Shareholding Pattern

| Promoters | 49.62% |

| FII | 17.94% |

| DII | 5.57% |

| Public | 26.87% |

Read Also:- CEAT Share Price Target 2025 To 2030- Current Chart, Market Overview