Manba Finance Share Price Target 2025 To 2030- Current Chart, Market Overview

Manba Finance is a fast-growing non-banking financial company (NBFC) in India, primarily focusing on two-wheeler financing. Established with the goal of making vehicle ownership easier for individuals, the company offers flexible loan options, quick approvals, and customer-friendly services. Over the years, it has expanded its financial services to cater to a broader customer base, including personal and business loans. Manba Finance is known for its strong customer support, digital lending solutions, and efficient credit screening process, which help in maintaining a healthy loan portfolio. Manba Finance Share Price on NSE as of 4 April 2025 is 135.38 INR.

Manba Finance Share Price Chart

Manba Finance Market Overview

- Open: 135.50

- High: 137.20

- Low: 133.22

- Previous Close: 136.19

- Volume: 119,933

- Value (Lacs): 161.17

- VWAP: 134.75

- UC Limit: 163.42

- LC Limit: 108.95

- 52 Week High: 199.80

- 52 Week Low: 119.00

- Mkt Cap (Rs. Cr.): 675

- Face Value: 10

Manba Finance Share Price Target 2025 To 2030

| Manba Finance Share Price Target Years | Manba Finance Share Price |

| 2025 | ₹200 |

| 2026 | ₹250 |

| 2027 | ₹300 |

| 2028 | ₹350 |

| 2029 | ₹400 |

| 2030 | ₹450 |

Manba Finance Share Price Target 2025

Manba Finance share price target 2025 Expected target could be ₹200. Manba Finance Limited is a non-banking financial company (NBFC) specializing in vehicle financing, particularly two-wheelers and three-wheelers, including electric variants. Several key factors are likely to influence the growth of Manba Finance’s share price by 2025:

-

Asset Under Management (AUM) Growth: The company’s AUM increased from ₹495.83 crore in FY2022 to ₹936.85 crore in FY2024, reflecting a compound annual growth rate (CAGR) of 37.46%. Sustaining this growth trajectory is crucial for enhancing market valuation.

-

Profitability Metrics: In Q3 FY2025, Manba Finance reported a Profit After Tax (PAT) of ₹12.96 crore, a 168.34% year-on-year increase. Consistent profitability can boost investor confidence and positively impact share prices.

-

Diversification of Loan Portfolio: Expanding into used car financing, personal loans, and inventory funding for two-wheeler dealers can mitigate risks associated with over-reliance on a single segment and open new revenue streams.

-

Geographical Expansion: While primarily operating in Maharashtra, plans to establish branches in Gujarat and other states could enhance market reach and contribute to growth.

-

Asset Quality Management: Maintaining low Gross Non-Performing Assets (GNPA) is vital. As of December 31, 2021, GNPA stood at 5.62%. Effective risk management strategies are essential to sustain asset quality.

-

Capital Adequacy: A comfortable Capital Adequacy Ratio (CAR) of 33.45% as of September 30, 2022, indicates financial stability. Ensuring adequate capitalization supports growth initiatives and regulatory compliance.

-

Interest and Employee Expenses: In FY2024, the company allocated 42.73% of its operating revenues to interest expenses and 20.06% to employee costs. Efficient cost management can enhance profitability.

-

Regulatory Environment: Adherence to Reserve Bank of India (RBI) guidelines and responsiveness to regulatory changes are critical to avoid sanctions and maintain operational continuity.

Manba Finance Share Price Target 2030

Manba Finance share price target 2030 Expected target could be ₹450. Here are 8 key factors that could influence the growth of Manba Finance’s share price by 2030:

-

Expansion into New Financial Segments – Manba Finance may diversify beyond two-wheeler loans into used car financing, MSME loans, and digital lending, which could drive long-term revenue growth.

-

Adoption of Digital Lending & Fintech Innovations – Investing in AI-driven risk assessment, digital loan approvals, and online customer onboarding can enhance efficiency and attract more borrowers.

-

Geographical Expansion – Expanding operations from Maharashtra to other states, including Gujarat, Karnataka, and Telangana, will increase market penetration and revenue streams.

-

Interest Rate Fluctuations & Economic Conditions – The company’s borrowing costs and lending rates will be impacted by RBI policies, inflation rates, and overall economic conditions affecting consumer borrowing behavior.

-

Non-Performing Assets (NPA) Control – Maintaining a low level of NPAs is crucial for investor confidence. Strong credit screening and collection mechanisms will help sustain financial health.

-

Strategic Partnerships & Collaborations – Tie-ups with vehicle manufacturers, fintech companies, and e-commerce platforms could help boost loan disbursement and brand visibility.

-

Regulatory Compliance & Policy Changes – Adhering to RBI norms, potential new NBFC regulations, and financial reforms will be vital in sustaining trust and avoiding legal hurdles.

-

Stock Market & Investor Sentiment – The company’s ability to consistently post strong financial results, increase profitability, and maintain transparency will influence investor confidence and share price performance.

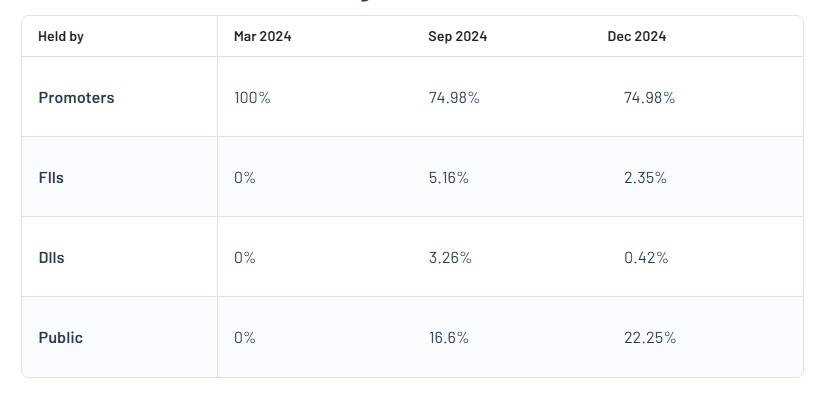

Manba Finance Shareholding Pattern

| Promoters | 74.98% |

| FII | 2.35% |

| DII | 0.42% |

| Public | 22.25% |

Read Also:- Urban Enviro Share Price Target 2025 To 2030- Current Chart, Market Overview