KEC International Share Price Target 2025 To 2030- Current Chart, Market Overview

KEC International is one of India’s leading infrastructure companies, well-known for its strong presence in power transmission and distribution. Part of the RPG Group, KEC has expanded its reach to railways, civil construction, and even smart city projects. The company is actively involved in projects not just in India, but also across the globe, which makes its business more stable and diversified. KEC International Share Price on NSE as of 12 April 2025 is 659.85 INR.

KEC International Share Price Chart

KEC International Market Overview

- Open: 680.45

- Previous Close: 658.00

- Volume: 1,004,159

- Value (Lacs): 6,627.95

- VWAP: 661.19

- High: 682.50

- Low: 657.00

- UC Limit: 789.60

- LC Limit: 526.40

- 52 Week High: 1,313.25

- 52 Week Low: 627.45

- Mkt Cap (Rs. Cr.): 17,570

- Face Value: 2

KEC International Share Price Target 2025 To 2030

| KEC International Share Price Target Years | KEC International Share Price |

| 2025 | ₹1320 |

| 2026 | ₹1400 |

| 2027 | ₹1500 |

| 2028 | ₹1600 |

| 2029 | ₹1700 |

| 2030 | ₹1800 |

KEC International Share Price Target 2025

KEC International share price target 2025 Expected target could be ₹1320. Here are 8 key factors affecting the growth of KEC International Share Price Target 2025:

-

Strong Order Book

KEC International’s growing order book across sectors like power transmission, railways, and civil works provides strong revenue visibility for 2025. -

Government Infrastructure Push

Continued focus by the Indian government on infrastructure development, especially in power and railways, can boost the company’s growth prospects. -

Global Expansion

KEC’s expanding international presence, especially in Africa, Middle East, and Southeast Asia, can open up new revenue streams. -

Raw Material Prices

Fluctuations in prices of steel, copper, and other raw materials can impact margins and profitability. -

Execution Efficiency

Timely execution of projects and effective cost management will play a key role in maintaining profitability and investor confidence. -

Policy Support

Positive government policies like “Atmanirbhar Bharat” and renewable energy expansion will benefit the company’s operations. -

Diversification into New Sectors

KEC’s efforts to diversify into urban infrastructure, cables, and solar energy projects add growth avenues. -

Global Economic Conditions

The state of the global economy, especially recovery in emerging markets, can influence the company’s exports and overseas projects.

KEC International Share Price Target 2030

KEC International share price target 2030 Expected target could be ₹1800. Here are 8 key factors affecting the growth of KEC International Share Price Target 2030:

-

Long-Term Infrastructure Growth

The increasing global and domestic investment in infrastructure projects, especially power transmission and railways, will be crucial for sustained growth till 2030. -

Renewable Energy Opportunities

The shift towards renewable energy and green transmission lines will open up new markets and projects for KEC International. -

Technological Advancements

Adoption of advanced construction technologies and automation can help improve efficiency and reduce costs over the long term. -

Geographical Diversification

Expansion into untapped international markets will provide more stability and reduce dependence on any single region. -

Strong Order Pipeline

Maintaining a healthy and diversified order book across sectors will ensure steady revenue flow in the coming years. -

Global Economic Stability

Global economic trends and trade relations will play a key role in international project execution and profitability. -

Policy and Regulatory Environment

Supportive government policies on infrastructure development, renewable energy, and exports will positively influence growth. -

Focus on Sustainability

Increasing global focus on sustainable development and eco-friendly infrastructure will help KEC secure future projects aligned with ESG goals.

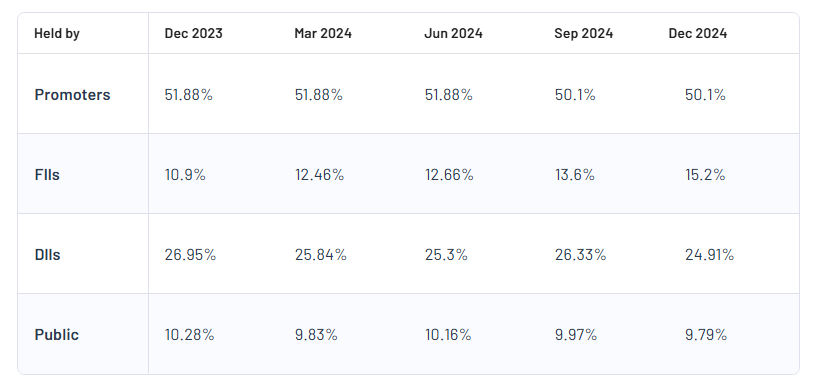

KEC International Shareholding Pattern

| Promoters | 50.1% |

| FII | 15.2% |

| DII | 24.91% |

| Public | 9.79% |

Read Also:- IOB Share Price Target 2025 To 2030- Current Chart, Market Overview