JM Financials Share Price Target 2025 To 2030- Current Chart, Market Overview

JM Financial is a well-known financial services company in India, offering a wide range of services, including investment banking, wealth management, asset management, and lending solutions. Established with a strong reputation in the financial sector, the company has played a key role in supporting businesses, investors, and individuals with their financial needs. JM Financial is known for its expertise in mergers and acquisitions, structured finance, and capital market transactions. JM Financials Share Price on NSE as of 31 March 2025 is 95.10 INR.

JM Financials Share Price Chart

JM Financials Market Overview

- Open: 96.40

- High: 98.83

- Low: 95.00

- Previous Close: 95.83

- Volume: 3,116,225

- Value (Lacs): 2,994.38

- VWAP: 96.75

- UC Limit: 114.99

- LC Limit: 76.66

- 52 Week High: 168.75

- 52 Week Low: 69.00

- Mkt Cap (Rs. Cr.): 9,184

- Face Value: 1

JM Financials Share Price Target 2025 To 2030

| JM Financials Share Price Target Years | JM Financials Share Price |

| 2025 | ₹170 |

| 2026 | ₹190 |

| 2027 | ₹210 |

| 2028 | ₹230 |

| 2029 | ₹250 |

| 2030 | ₹270 |

JM Financials Share Price Target 2025

JM Financials share price target 2025 Expected target could be ₹170. Here are 8 Key Factors Affecting Growth for JM Financial Share Price Target 2025:

-

Market Performance & Economic Conditions – The overall stock market trends and economic growth in India will impact JM Financial’s share price movement.

-

Interest Rate Fluctuations – Changes in RBI’s monetary policies and interest rates can affect borrowing costs and profitability for financial companies like JM Financial.

-

Business Growth & Revenue Performance – The company’s ability to grow its investment banking, wealth management, and lending businesses will influence its stock performance.

-

Regulatory Changes – Government policies and SEBI regulations on financial services can either support or hinder JM Financial’s expansion and profitability.

-

Asset Quality & Loan Portfolio – The level of non-performing assets (NPAs) in its lending business will impact investor confidence and stock valuation.

-

Competition in the Financial Sector – Rising competition from banks, NBFCs, and fintech companies can affect JM Financial’s market share and earnings.

-

Foreign & Domestic Investment Trends – Institutional and retail investor participation in JM Financial’s stock will play a key role in its price movement.

-

Global Financial Market Trends – Economic conditions in major global markets, foreign investments, and geopolitical factors can have an indirect effect on JM Financial’s stock performance.

JM Financials Share Price Target 2030

JM Financials share price target 2030 Expected target could be ₹270. Here are 8 Key Factors Affecting Growth for JM Financial Share Price Target 2030:

-

Long-Term Economic Growth – India’s overall economic growth and financial sector expansion will play a crucial role in JM Financial’s stock performance.

-

Diversification of Business Segments – Expansion into new financial services like asset management, private equity, and fintech solutions can drive revenue growth.

-

Digital Transformation & Technology Adoption – The company’s ability to leverage technology for investment banking, wealth management, and lending will be a key growth factor.

-

Regulatory Environment & Compliance – Changes in financial regulations, SEBI guidelines, and taxation policies will impact the company’s business model and profitability.

-

Interest Rate & Inflation Trends – Long-term interest rate movements and inflation levels will influence borrowing costs and investment decisions, affecting JM Financial’s financial health.

-

Global Investment & Foreign Institutional Investors (FII) Inflows – Increased foreign investments in the Indian financial sector can boost JM Financial’s valuation and stock price.

-

Competitive Landscape – Growing competition from banks, NBFCs, and fintech players will shape the company’s market positioning and future profitability.

-

Sustainability & ESG (Environmental, Social, and Governance) Factors – Investor focus on ethical investing and sustainable finance could impact JM Financial’s growth strategies and investor appeal.

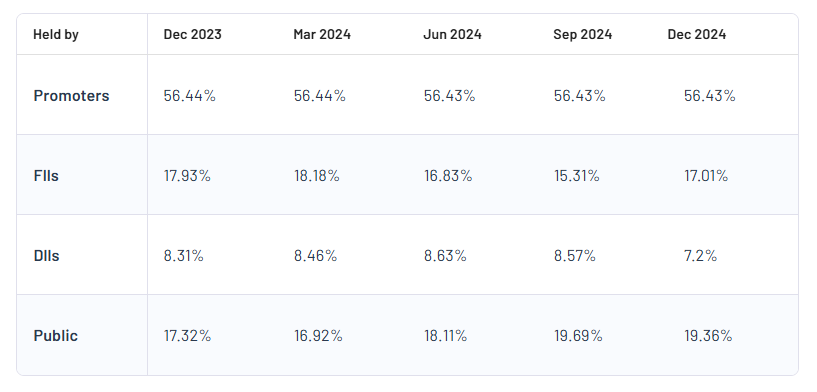

JM Financials Shareholding Pattern

| Promoters | 56.43% |

| FII | 17.01% |

| DII | 7.2% |

| Public | 19.36% |

Read Also:- LT Foods Share Price Target 2025 To 2030- Current Chart, Market Overview