Indian Infotech Share Price Target 2025 To 2030- Current Chart, Market Overview

Indian Infotech is a growing technology company from India that provides various IT solutions and services to businesses. The company focuses on helping its clients with digital transformation, software development, data management, and cybersecurity. Indian Infotech Share Price on NSE as of 7 April 2025 is 1.08 INR.

Indian Infotech Share Price Chart

Indian Infotech Market Overview

- Open: 1.10

- High: 1.10

- Low: 1.02

- Previous Close: 1.12

- Volume: 2,628,904

- Value (Lacs): 28.39

- VWAP: 1.06

- UC Limit: 1.29

- LC Limit: 0.87

- 52 Week High: 1.78

- 52 Week Low: 1.02

- Mkt Cap (Rs. Cr.): 136

- Face Value: 1

Indian Infotech Share Price Target 2025 To 2030

| Indian Infotech Share Price Target Years | Indian Infotech Share Price |

| 2025 | ₹1.80 |

| 2026 | ₹2.10 |

| 2027 | ₹2.40 |

| 2028 | ₹2.80 |

| 2029 | ₹3.20 |

| 2030 | ₹3.60 |

Indian Infotech Share Price Target 2025

Indian Infotech share price target 2025 Expected target could be ₹1.80. Here are 8 key factors affecting the growth of Indian Infotech Share Price Target 2025:

-

Expansion of Digital Services

Growth in demand for digital transformation services and IT solutions can boost Indian Infotech’s revenue and positively impact its share price. -

Technological Innovation

Adoption of emerging technologies like AI, cloud computing, and cybersecurity services can improve the company’s market position. -

Client Acquisition and Retention

Gaining new clients and maintaining strong relationships with existing ones will play a vital role in sustaining growth. -

Global IT Spending Trends

Increased IT spending by businesses globally will create more opportunities for service providers like Indian Infotech. -

Government Initiatives for Digital India

Supportive government policies and initiatives aimed at promoting digitalization will encourage growth in the sector. -

Talent Acquisition and Skill Development

Availability of skilled professionals and investment in employee development will ensure the delivery of quality services. -

Economic Conditions

Stable macroeconomic factors, both domestically and globally, will influence the overall market sentiment and the company’s performance. -

Competition in the IT Sector

Rising competition from domestic and international IT companies can impact growth prospects, pricing power, and margins.

Indian Infotech Share Price Target 2030

Indian Infotech share price target 2030 Expected target could be ₹3.60. Here are 8 key factors affecting the growth of Indian Infotech Share Price Target 2030:

-

Long-Term Digital Transformation Trends

As businesses worldwide continue their digital journeys, the sustained demand for IT services will benefit Indian Infotech in the long run. -

Global Expansion Strategy

Entering new international markets and expanding their client base globally can provide significant growth opportunities. -

Adoption of Emerging Technologies

Continued investment in advanced technologies like AI, IoT, blockchain, and big data will help Indian Infotech stay ahead of the curve. -

Strong Partnerships and Alliances

Collaborations with global tech leaders and other businesses can boost capabilities and open new revenue streams. -

Recurring Revenue Models

Building a stable, recurring revenue model through long-term service contracts and subscription-based offerings will strengthen financial predictability. -

Cybersecurity Focus

As cyber threats increase, Indian Infotech’s focus on providing robust cybersecurity solutions can attract more clients and grow its reputation. -

Economic and Regulatory Environment

Supportive regulations and favorable economic conditions, both in India and globally, will positively impact growth. -

Sustainability and ESG Initiatives

A strong emphasis on sustainable practices and Environmental, Social, and Governance (ESG) goals can attract socially responsible investors and enhance brand value.

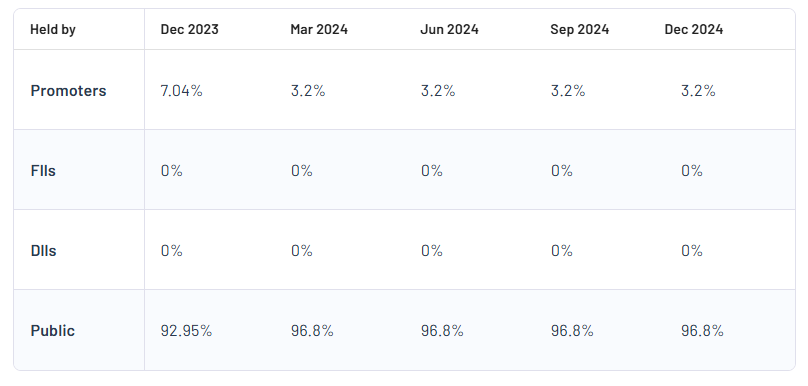

Indian Infotech Shareholding Pattern

| Promoters | 3.2% |

| FII | 0% |

| DII | 0% |

| Public | 96.8% |

Read Also:- Va Tech Wabag Share Price Target 2025 To 2030- Current Chart, Market Overview