Indegne Share Price Target 2025 To 2030- Current Chart, Market Overview

Indegene is a global company that helps healthcare and life sciences organizations with digital transformation. It offers services like medical and marketing solutions, analytics, and technology platforms to improve how healthcare companies work and connect with their customers. Indegne Price on NSE as of 10 April 2025 is 551.00 INR.

Indegne Price Chart

Indegne Market Overview

- Open: 545.00

- High: 562.45

- Low: 534.80

- Previous Close: 550.60

- Volume: 334,371

- Value (Lacs): 1,849.24

- VWAP: 551.00

- UC Limit: 660.70

- LC Limit: 440.50

- 52 Week High: 736.30

- 52 Week Low: 470.10

- Mkt Cap (Rs. Cr.): 13,232

- Face Value: 2

Indegne Price Target 2025 To 2030

| Indegne Price Target Years | Indegne Price |

| 2025 | ₹750 |

| 2026 | ₹800 |

| 2027 | ₹850 |

| 2028 | ₹900 |

| 2029 | ₹950 |

| 2030 | ₹1000 |

Indegne Price Target 2025

Indegne share price target 2025 Expected target could be ₹750. Here are 8 key factors that could affect the growth of Indegene share price target for 2025:

-

Expansion in Healthcare Solutions

Indegene’s growth depends on how well it expands its digital healthcare services, like patient support, medical affairs, and commercial operations for pharma companies. -

Global Client Acquisitions

More international clients, especially big pharmaceutical and biotech companies, can help increase revenue and market presence. -

Technological Advancements

Adoption of advanced technologies like AI, data analytics, and automation can improve efficiency and attract more customers. -

Regulatory Environment

Any changes in healthcare regulations globally, especially in the US and Europe, can impact the demand for Indegene’s services. -

Strategic Partnerships and Acquisitions

Collaborations or acquisitions can help Indegene quickly expand its capabilities and reach new markets. -

Demand for Digital Transformation

As more healthcare companies focus on digital transformation, Indegene’s services will be in higher demand. -

Talent Acquisition and Retention

Having skilled professionals is crucial for growth, as Indegene depends heavily on expertise in healthcare and technology. -

Global Economic Conditions

Overall economic health, especially in key markets, will influence client spending and project flows, affecting revenue growth.

Indegne Price Target 2030

Indegne share price target 2030 Expected target could be ₹1000. Here are 8 key factors that could affect the growth of Indegene share price target for 2030:

-

Long-Term Global Healthcare Digitization

As the world moves towards digital healthcare solutions, Indegene can benefit from long-term demand for its tech-driven services. -

Expansion into New Geographies

Entering emerging markets and strengthening its presence in developed regions can boost its global footprint. -

Growth in Pharma R&D Spending

Increasing investments in pharmaceutical research and development will drive demand for Indegene’s specialized services. -

Advanced Data & AI Integration

Deep integration of artificial intelligence and data analytics can enhance service offerings and attract high-value clients. -

Strategic Mergers & Acquisitions

Acquiring complementary businesses can help Indegene expand its service portfolio and customer base faster. -

Long-Term Contracts with Big Pharma

Securing multi-year contracts with major pharmaceutical companies will provide revenue stability and visibility. -

Focus on Innovation & Custom Solutions

Continued innovation in delivering customized solutions can strengthen client relationships and improve market competitiveness. -

Global Regulatory Adaptability

Staying ahead of changing global healthcare regulations will help Indegene maintain smooth operations across markets.

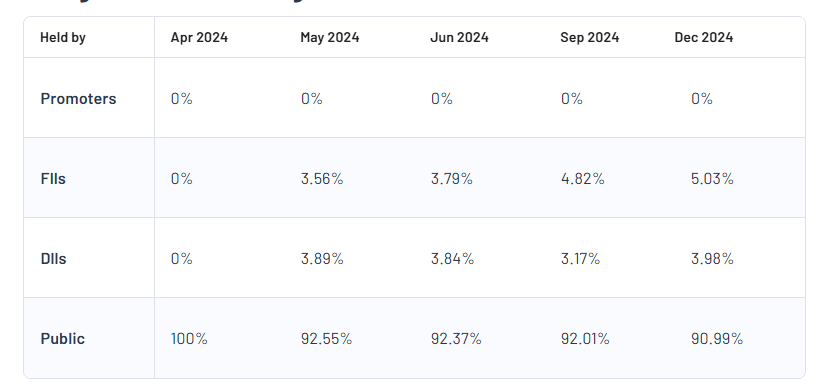

Indegne Shareholding Pattern

| Promoters | 0% |

| FII | 5.03% |

| DII | 3.98% |

| Public | 90.99% |

Read Also:- Hudco Share Price Target 2025 To 2030- Current Chart, Market Overview