IGL Share Price Target 2025 To 2030- Current Chart, Market Overview

Indraprastha Gas Limited (IGL) is one of India’s leading natural gas distribution companies, supplying Compressed Natural Gas (CNG) and Piped Natural Gas (PNG) to households, industries, and commercial establishments. Established in 1998, IGL plays a crucial role in promoting cleaner energy alternatives, helping reduce pollution by replacing traditional fuels with eco-friendly natural gas. The company operates mainly in Delhi-NCR and has been expanding its network to other cities as well. IGL Share Price on NSE as of 31 March 2025 is 203.78 INR.

IGL Share Price Chart

IGL Market Overview

- Open: 197.99

- High: 204.36

- Low: 193.85

- Previous Close: 195.50

- Volume: 6,862,377

- Value (Lacs): 13,938.86

- VWAP: 201.97

- UC Limit: 215.05

- LC Limit: 175.95

- 52 Week High: 285.18

- 52 Week Low: 153.05

- Mkt Cap (Rs. Cr.): 28,436

- Face Value: 2

IGL Share Price Target 2025 To 2030

| IGL Share Price Target Years | IGL Share Price |

| 2025 | ₹290 |

| 2026 | ₹310 |

| 2027 | ₹330 |

| 2028 | ₹350 |

| 2029 | ₹370 |

| 2030 | ₹390 |

IGL Share Price Target 2025

IGL share price target 2025 Expected target could be ₹290. Here are 8 Key Factors Affecting Growth for Indraprastha Gas Limited (IGL) Share Price Target 2025:

-

Rising Demand for Natural Gas – Increasing adoption of Compressed Natural Gas (CNG) and Piped Natural Gas (PNG) in households, industries, and vehicles will drive revenue growth.

-

Government Policies & Support – Policies promoting clean energy, subsidies for natural gas, and favorable taxation on CNG can benefit IGL’s business expansion.

-

Expansion of City Gas Distribution (CGD) – Expanding its gas pipeline network to new cities and regions will contribute to long-term revenue growth.

-

Crude Oil & Natural Gas Prices – Fluctuations in global crude oil and LNG prices impact the cost of natural gas supply and, in turn, IGL’s profit margins.

-

Competition from Alternative Fuels – The rise of electric vehicles (EVs) and renewable energy solutions may impact the demand for CNG in the long run.

-

Infrastructure Development – Investment in expanding gas pipelines, fuel stations, and network capacity will influence IGL’s growth potential.

-

Financial Performance & Profitability – Strong revenue, consistent profit margins, and cost management will boost investor confidence and share price performance.

-

Macroeconomic & Market Conditions – Economic growth, inflation trends, and consumer spending patterns will affect industrial and residential gas consumption, influencing IGL’s overall performance.

IGL Share Price Target 2030

IGL share price target 2030 Expected target could be ₹390. Here are 8 Key Factors Affecting Growth for Indraprastha Gas Limited (IGL) Share Price Target 2030:

-

Expansion of City Gas Distribution (CGD) – IGL’s long-term growth will depend on how effectively it expands its CGD network across more cities and industrial hubs.

-

Government Policies & Regulations – Continued government support for clean energy and policies favoring natural gas adoption will play a crucial role in IGL’s future growth.

-

Shift Towards Renewable Energy & EVs – The growing adoption of electric vehicles (EVs) and renewable energy sources may reduce demand for CNG in the long run.

-

Global Energy Price Trends – Fluctuations in crude oil and natural gas prices will affect supply costs and profitability for IGL.

-

Infrastructure Development & Investments – Increased investment in gas pipelines, fueling stations, and network expansion will help sustain IGL’s growth momentum.

-

Industrial & Commercial Demand – Rising energy needs in industries, commercial establishments, and households will impact the company’s long-term revenue potential.

-

Technological Advancements – Innovations in gas distribution, smart metering, and efficiency improvements could enhance operational performance and profitability.

-

Macroeconomic & Market Trends – Factors like GDP growth, inflation, and consumer behavior will influence energy consumption patterns, impacting IGL’s stock performance by 2030.

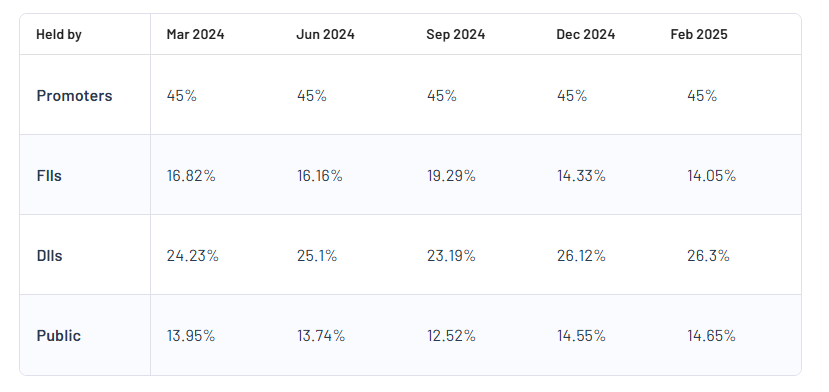

IGL Shareholding Pattern

| Promoters | 45% |

| FII | 14.05% |

| DII | 26.3% |

| Public | 14.65% |

Read Also:- JM Financials Share Price Target 2025 To 2030- Current Chart, Market Overview