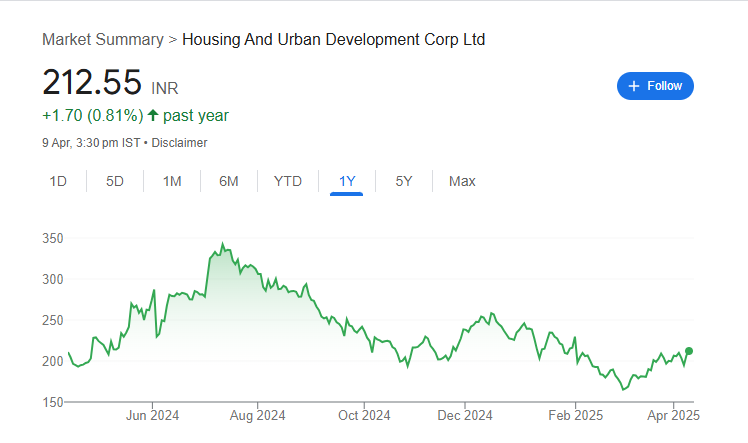

Hudco Share Price Target 2025 To 2030- Current Chart, Market Overview

HUDCO, which stands for Housing and Urban Development Corporation, is a government-owned company in India that plays a big role in building the nation’s housing and urban infrastructure. Established to support affordable housing and develop cities, HUDCO helps by providing loans for housing projects, water supply systems, roads, and other essential services. It focuses especially on making homes more accessible for lower and middle-income families. Hudco Price on NSE as of 10 April 2025 is 212.55 INR.

Hudco Price Chart

Hudco Market Overview

- Open: 207.01

- High: 213.64

- Low: 201.50

- Previous Close: 207.01

- Volume: 15,070,362

- Value (Lacs): 32,077.27

- VWAP: 208.79

- UC Limit: 227.71

- LC Limit: 186.30

- 52 Week High: 353.70

- 52 Week Low: 158.85

- Mkt Cap (Rs. Cr.): 42,610

- Face Value: 10

Hudco Price Target 2025 To 2030

| Hudco Price Target Years | Hudco Price |

| 2025 | ₹360 |

| 2026 | ₹390 |

| 2027 | ₹420 |

| 2028 | ₹450 |

| 2029 | ₹480 |

| 2030 | ₹510 |

Hudco Price Target 2025

Hudco share price target 2025 Expected target could be ₹360. Here are 8 key factors affecting the growth for “HUDCO (Housing and Urban Development Corporation) Price Target 2025”:

-

Government Housing Policies

Supportive government initiatives like “Housing for All” and Pradhan Mantri Awas Yojana can drive HUDCO’s growth by increasing demand for affordable housing finance. -

Urban Infrastructure Development

HUDCO benefits from rising investments in urban infrastructure projects, like smart cities, sanitation, and water supply improvements. -

Interest Rate Movements

Changes in interest rates by the Reserve Bank of India (RBI) will directly impact borrowing costs and the demand for housing loans. -

Economic Growth

A stronger economy boosts overall construction and housing demand, which positively affects HUDCO’s lending activities and earnings. -

Project Execution Efficiency

Timely completion and efficient management of funded projects enhance profitability and investor confidence in HUDCO. -

Diversification of Loan Portfolio

Expanding beyond housing into other urban development projects can reduce risk and create additional revenue streams. -

Credit Ratings and Liquidity

HUDCO’s credit rating impacts its ability to raise funds at competitive rates, which is crucial for sustaining growth. -

Regulatory Environment

Policies related to housing finance companies, urban development, and financial regulations will influence HUDCO’s operational flexibility and growth prospects.

Hudco Price Target 2030

Hudco share price target 2030 Expected target could be ₹510. Here are 8 key factors affecting the growth for “HUDCO (Housing and Urban Development Corporation) Price Target 2030”:

-

Long-Term Urbanization Trends

With more people moving to cities, the demand for housing and urban infrastructure is expected to grow, benefiting HUDCO’s core business. -

Government Mega Projects

Initiatives like Smart Cities Mission, AMRUT, and infrastructure corridors will continue to create opportunities for HUDCO’s financing solutions. -

Affordable Housing Push

The ongoing government focus on affordable housing will sustain high demand for HUDCO’s services, especially for lower and middle-income groups. -

Technological Advancements in Construction

Adoption of modern construction technologies can improve project efficiency and reduce costs, enhancing HUDCO’s profitability. -

Sustainable Development Goals (SDGs)

Growing emphasis on green buildings and sustainable urban development will open new financing avenues for HUDCO. -

Access to Low-Cost Funding

HUDCO’s ability to maintain strong credit ratings and tap into low-cost capital will be crucial for future expansion. -

Economic and Demographic Growth

Rising income levels, favourable demographics, and a growing middle class will continue to drive demand for urban infrastructure and housing. -

Policy and Regulatory Support

Stable and supportive regulatory frameworks, along with incentives for urban development, will be vital for HUDCO’s long-term growth trajectory.

Hudco Shareholding Pattern

| Promoters | 75% |

| FII | 2.1% |

| DII | 9.7% |

| Public | 13.2% |