GSFC Share Price Target 2025 To 2030- Current Chart, Market Overview

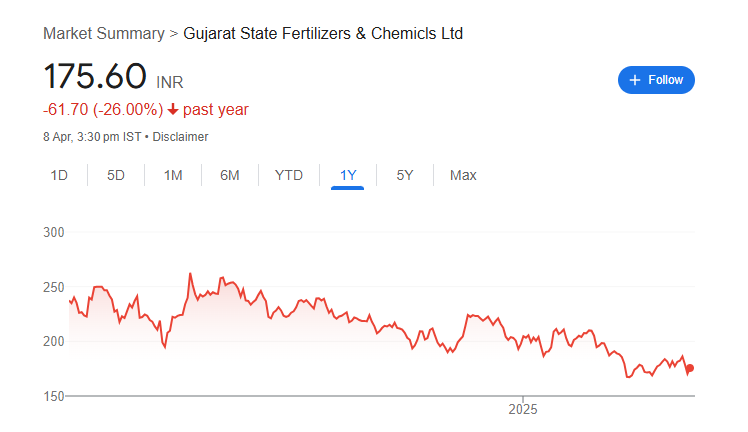

Gujarat State Fertilizers & Chemicals Ltd. (GSFC) is a well-known Indian company that plays an important role in supporting the agriculture and chemical industries. Founded in 1962, GSFC produces a wide range of fertilizers like urea and DAP, as well as various industrial chemicals. These products help farmers improve their crop yields and also support industries such as textiles, paper, and construction. The company is deeply committed to innovation and sustainability, constantly working on eco-friendly solutions and efficient manufacturing processes. GSFC Share Price on NSE as of 8 April 2025 is 175.60 INR.

GSFC Share Price Chart

GSFC Market Overview

- Open: 174.00

- High: 176.10

- Low: 171.73

- Previous Close: 170.30

- Volume: 737,842

- Value (Lacs): 1,290.93

- VWAP: 173.94

UC Limit: 204.36 - LC Limit: 136.24

- 52 Week High: 274.70

- 52 Week Low: 158.30

- Mkt Cap (Rs. Cr.): 6,971

- Face Value: 2

GSFC Share Price Target 2025 To 2030

| GSFC Share Price Target Years | GSFC Share Price |

| 2025 | ₹280 |

| 2026 | ₹340 |

| 2027 | ₹380 |

| 2028 | ₹420 |

| 2029 | ₹460 |

| 2030 | ₹500 |

GSFC Share Price Target 2025

GSFC share price target 2025 Expected target could be ₹280. Here are 8 key factors that can affect the growth of GSFC (Gujarat State Fertilizers & Chemicals Ltd.) share price target for 2025:

-

Agriculture Demand Growth

As GSFC is a major fertilizer producer, increasing demand from the agriculture sector can directly boost the company’s sales and profits. -

Government Policies & Subsidies

Supportive policies and subsidies for fertilizers by the government will positively impact GSFC’s growth. -

Raw Material Prices

Fluctuations in prices of raw materials like natural gas and phosphoric acid can affect production costs and profitability. -

Expansion Plans

If GSFC successfully expands its production capacity or launches new products, it can drive future growth. -

Export Opportunities

Exploring export markets can open new revenue streams and reduce dependency on domestic sales. -

Technological Advancements

Adopting modern technology for efficient production and sustainable practices can improve margins and competitiveness. -

Monsoon Conditions

Good monsoon seasons increase agricultural activities, which boosts fertilizer demand and benefits GSFC. -

Global Fertilizer Market Trends

Changes in global demand and supply of fertilizers will impact GSFC’s pricing power and profitability.

GSFC Share Price Target 2030

GSFC share price target 2030 Expected target could be ₹500. Here are 8 key factors that can affect the growth of GSFC (Gujarat State Fertilizers & Chemicals Ltd.) share price target for 2030:

-

Long-Term Agricultural Growth

With India focusing on improving agricultural productivity, the long-term demand for fertilizers like those made by GSFC is expected to rise steadily. -

Diversification of Product Portfolio

If GSFC expands into specialty chemicals or value-added products, it can create new growth avenues beyond traditional fertilizers. -

Global Market Expansion

Increasing exports to international markets will help GSFC reduce its dependence on the domestic market and capture global opportunities. -

Sustainability & Green Initiatives

Investments in eco-friendly products and sustainable manufacturing processes can improve GSFC’s reputation and attract green investors. -

Strategic Partnerships

Collaborations with international firms or research institutions can bring in advanced technology and better market reach. -

Government’s Push for Self-Reliance

“Atmanirbhar Bharat” initiatives supporting domestic manufacturing of fertilizers and chemicals can benefit GSFC in the long run. -

Infrastructure Development

Improved rural infrastructure like irrigation facilities can boost fertilizer usage, positively impacting GSFC’s sales. -

Technological Modernization

Adopting advanced manufacturing technologies can improve efficiency, reduce costs, and enhance profitability over the years.

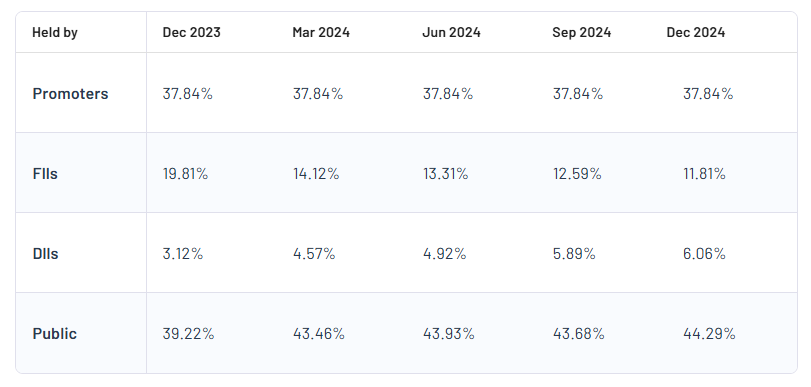

GSFC Shareholding Pattern

| Promoters | 37.84% |

| FII | 11.81% |

| DII | 6.06% |

| Public | 44.29% |

Read Also:- DLF Share Price Target 2025 To 2030- Current Chart, Market Overview