Godrej Industries Share Price Target 2025 To 2030- Current Chart, Market Overview

Godrej Industries is a well-known Indian conglomerate with a strong presence in multiple sectors, including consumer goods, chemicals, real estate, and agriculture. Part of the trusted Godrej Group, the company has built a solid reputation for quality and innovation over the years. It operates in diverse industries, manufacturing products like personal care items, home care solutions, specialty chemicals, and animal feed. Through its real estate arm, Godrej Properties, the company has also made a mark in the construction and housing sector. Godrej Industries Share Price on NSE as of 31 March 2025 is 1,132.00 INR.

Godrej Industries Share Price Chart

Godrej Industries Market Overview

- Open: 1,168.25

- High: 1,175.00

- Low: 1,128.30

- Previous Close: 1,159.90

- Volume: 87,679

- Value (Lacs): 994.41

- VWAP: 1,148.64

- UC Limit: 1,275.85

- LC Limit: 1,043.95

- 52 Week High: 1,314.00

- 52 Week Low: 725.00

- Mkt Cap (Rs. Cr.): 38,192

- Face Value: 1

Godrej Industries Share Price Target 2025 To 2030

| Godrej Industries Share Price Target Years | Godrej Industries Share Price |

| 2025 | ₹1314 |

| 2026 | ₹1600 |

| 2027 | ₹1900 |

| 2028 | ₹2200 |

| 2029 | ₹2500 |

| 2030 | ₹2800 |

Godrej Industries Share Price Target 2025

Godrej Industries share price target 2025 Expected target could be ₹1314. Here are 8 Key Factors Affecting the Growth of Godrej Industries Share Price Target 2025:

-

Diversified Business Segments – Godrej Industries operates in various sectors, including chemicals, real estate, consumer goods, and agriculture, which can contribute to stable growth.

-

FMCG and Consumer Demand – The performance of its consumer goods division (Godrej Consumer Products) will play a crucial role in driving revenue growth.

-

Real Estate Market Trends – Growth in the real estate sector through Godrej Properties can significantly impact the company’s overall valuation.

-

Global Chemical Market Performance – The company’s chemical business, which serves both domestic and international markets, will be affected by global demand and raw material prices.

-

Government Policies & Regulations – Policies related to real estate, agriculture, and environmental regulations can influence the company’s operations and profitability.

-

Economic Growth & Inflation – A strong economy with rising disposable income can boost demand for Godrej’s consumer and real estate products, while inflation can impact raw material costs.

-

Expansion & Innovation – Investments in research, new product launches, and expansion into new markets will be key drivers for share price growth.

-

Stock Market Trends & Investor Sentiment – Overall market performance, FII/DII investments, and investor confidence in the company will play a crucial role in determining share price movement.

Godrej Industries Share Price Target 2030

Godrej Industries share price target 2030 Expected target could be ₹2800. Here are 8 Key Factors Affecting the Growth of Godrej Industries Share Price Target 2030:

-

Long-Term Expansion in FMCG Sector – Growth in Godrej Consumer Products, driven by increasing demand for personal care and household products, will play a significant role in long-term revenue generation.

-

Real Estate Development & Urbanization – With India’s expanding urban population, Godrej Properties is expected to benefit from increasing demand for residential and commercial spaces.

-

Sustainability & Green Initiatives – Investments in sustainable and eco-friendly solutions, especially in the chemical and real estate sectors, can enhance brand value and attract ESG-focused investors.

-

Agribusiness & Food Security Trends – Expansion in the agri-business segment, particularly in animal feed and dairy, can support revenue diversification and long-term stability.

-

Global Market Influence on Chemical Business – The company’s performance in the chemical sector will depend on international demand, crude oil prices, and evolving industry trends.

-

Technological Advancements & Innovation – Adoption of digital strategies, smart manufacturing, and automation can improve efficiency and profitability across its business verticals.

-

Economic & Market Cycles – India’s GDP growth, inflation rates, interest rates, and stock market trends will influence investor sentiment and stock performance in the long run.

-

Mergers, Acquisitions & Strategic Partnerships – Expansion through acquisitions, joint ventures, or strategic alliances can help Godrej Industries strengthen its market presence and drive long-term growth.

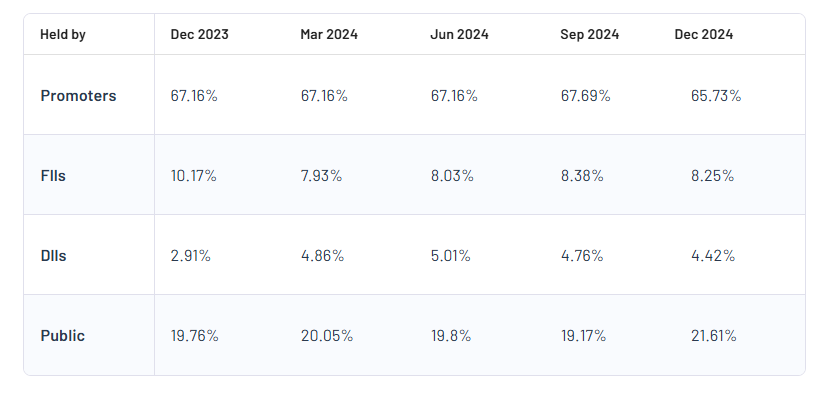

Godrej Industries Shareholding Pattern

| Promoters | 65.73% |

| FII | 8.25% |

| DII | 4.42% |

| Public | 21.61% |

Read Also:- IGL Share Price Target 2025 To 2030- Current Chart, Market Overview