Coforge Share Price Target 2025 To 2030- Current Chart, Market Overview

Coforge is a global IT services company known for its expertise in digital transformation, cloud computing, and AI-driven solutions. With a strong presence in industries like banking, insurance, travel, and healthcare, the company focuses on delivering innovative and customized technology solutions to its clients. Coforge has built a reputation for its customer-centric approach, cutting-edge technologies, and strategic partnerships. Coforge Share Price on NSE as of 31 March 2025 is 1,132.00 INR.

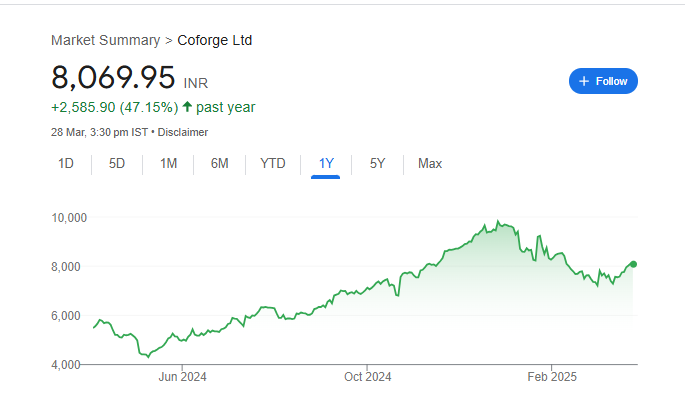

Coforge Share Price Chart

Coforge Market Overview

- Open: 8,172.45

- High: 8,250.00

- Low: 8,024.50

- Previous Close: 8,107.60

- Volume: 503,633.00

- Value (Lacs): 40,840.61

- VWAP: 8,152.56

- UC Limit: 8,918.35

- LC Limit: 7,296.85

- 52 Week High: 10,026.80

- 52 Week Low: 4,287.25

- Mkt Cap (Rs. Cr.): 54,233

- Face Value: 10.00

Coforge Share Price Target 2025 To 2030

| Coforge Share Price Target Years | Coforge Share Price |

| 2025 | ₹10,030 |

| 2026 | ₹13000 |

| 2027 | ₹16000 |

| 2028 | ₹19000 |

| 2029 | ₹22000 |

| 2030 | ₹25000 |

Coforge Share Price Target 2025

Coforge share price target 2025 Expected target could be ₹10,030. Here are 8 Key Factors Affecting the Growth of Coforge Share Price Target 2025:

-

IT Sector Growth – The demand for digital transformation, cloud computing, and automation in industries like BFSI, healthcare, and retail will drive Coforge’s revenue growth.

-

Global Economic Conditions – Economic slowdowns, inflation, and geopolitical tensions could impact client spending on IT services, affecting Coforge’s financial performance.

-

Large Deals & Client Acquisition – The company’s ability to secure long-term contracts and expand its global client base will influence revenue stability and share price movement.

-

Technological Advancements – Investments in AI, machine learning, cybersecurity, and blockchain will be key to maintaining competitiveness and driving business expansion.

-

Profit Margins & Cost Management – Efficient operational cost management, better pricing strategies, and improved margins will play a crucial role in determining the company’s profitability.

-

Rupee-Dollar Exchange Rate – Since Coforge earns a significant portion of its revenue from international markets, fluctuations in the rupee-dollar exchange rate could impact earnings.

-

Industry Competition – The presence of strong competitors like TCS, Infosys, and Wipro may put pressure on Coforge’s market share and pricing power.

-

Government & Regulatory Policies – Changes in tax policies, data privacy regulations, and visa restrictions in key markets like the U.S. and Europe can affect business operations and revenue growth.

Coforge Share Price Target 2030

Coforge share price target 2030 Expected target could be ₹25000. Here are 8 Key Factors Affecting the Growth of Coforge Share Price Target 2030:

-

Long-Term Digital Transformation Trends – The increasing adoption of cloud computing, AI, and automation across industries will drive sustained demand for Coforge’s IT services.

-

Expansion into New Markets – Coforge’s ability to enter new geographies, especially emerging markets, will be crucial for revenue diversification and long-term growth.

-

Strategic Acquisitions & Partnerships – Mergers, acquisitions, and alliances with global tech leaders can enhance service offerings and improve market positioning.

-

Innovation & Technological Advancements – Continued investment in next-gen technologies like blockchain, IoT, and cybersecurity will keep Coforge competitive in a fast-evolving IT landscape.

-

Global Economic Stability – The state of the global economy, interest rates, and inflation trends will influence corporate IT spending and Coforge’s revenue growth.

-

Client Retention & Deal Pipeline – The company’s ability to maintain long-term relationships with key clients and secure large deals will impact revenue stability and investor confidence.

-

Talent Acquisition & Workforce Management – Hiring and retaining top IT professionals, along with efficient cost management, will be critical for maintaining operational efficiency.

-

Regulatory & Compliance Factors – Changes in global regulations, such as data protection laws and immigration policies, can impact service delivery and business expansion strategies.

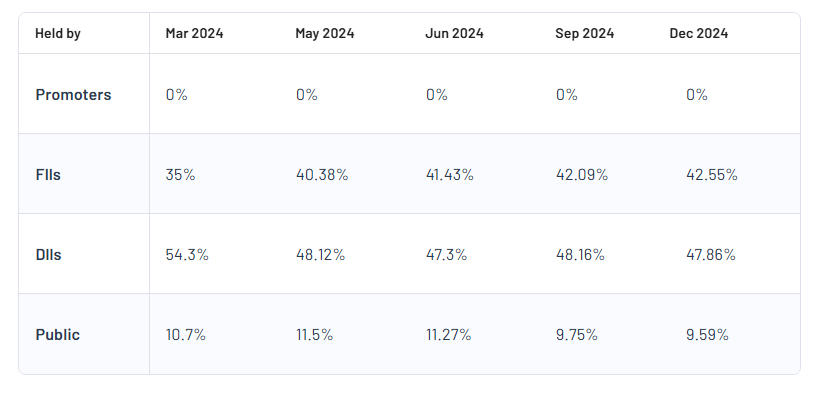

Coforge Shareholding Pattern

| Promoters | 0% |

| FII | 42.55% |

| DII | 47.86% |

| Public | 9.59% |

Read Also:- Godrej Industries Share Price Target 2025 To 2030- Current Chart, Market Overview