CEAT Share Price Target 2025 To 2030- Current Chart, Market Overview

CEAT is one of India’s leading tire manufacturers, known for producing high-quality tires for cars, bikes, trucks, and even specialty vehicles. Founded in 1958, the company has grown into a trusted name in the automotive industry, supplying tires not just in India but also in international markets. CEAT focuses on innovation, safety, and durability, offering a wide range of products suited for different road conditions. CEAT Share Price on NSE as of 1 April 2025 is 2,875.05 INR.

CEAT Share Price Chart

CEAT Market Overview

- Open: 2,860.00

- High: 2,910.00

- Low: 2,849.00

- Previous Close: 2,879.50

- Volume: 31,639

- Value (Lacs): 910.03

- VWAP: 2,883.31

- UC Limit: 3,455.40

- LC Limit: 2,303.60

- 52 Week High: 3,578.80

- 52 Week Low: 2,210.15

- Mkt Cap (Rs. Cr.): 11,634

- Face Value: 10

CEAT Share Price Target 2025 To 2030

| CEAT Share Price Target Years | CEAT Share Price |

| 2025 | ₹3580 |

| 2026 | ₹3900 |

| 2027 | ₹4100 |

| 2028 | ₹4300 |

| 2029 | ₹4500 |

| 2030 | ₹4700 |

CEAT Share Price Target 2025

CEAT share price target 2025 Expected target could be ₹3580. Here are 8 Key Factors Affecting Growth for CEAT Share Price Target 2025:

-

Raw Material Costs – The prices of key raw materials like rubber, crude oil, and synthetic rubber impact CEAT’s production costs and profit margins.

-

Demand in the Auto Sector – Growth in the automobile industry, especially in passenger and commercial vehicles, influences CEAT’s tire sales and revenue.

-

Expansion & Capacity Utilization – Investments in new manufacturing plants and increased production capacity can drive future growth.

-

Export Market Growth – CEAT’s presence in international markets and increasing exports will contribute to revenue diversification and profitability.

-

Electric Vehicle (EV) Adoption – The rise of EVs requires specialized tires, creating a new market opportunity for CEAT.

-

Competition in the Tire Industry – Rival companies like MRF, Apollo Tyres, and JK Tyre can impact CEAT’s market share and pricing strategies.

-

Government Policies & Regulations – Policies related to import duties, environmental regulations, and infrastructure development can influence CEAT’s growth.

-

Financial Performance & Investor Sentiment – Revenue growth, profit margins, debt levels, and overall market confidence will affect CEAT’s stock price movement in 2025.

CEAT Share Price Target 2030

CEAT share price target 2030 Expected target could be ₹4700. Here are 8 Key Factors Affecting Growth for CEAT Share Price Target 2030:

-

Technological Advancements – Innovations in tire manufacturing, including smart tires and sustainable materials, can improve CEAT’s market position.

-

Expansion into Global Markets – Strengthening its international presence and increasing exports will help CEAT diversify its revenue streams and reduce dependency on domestic sales.

-

Growth of Electric Vehicles (EVs) – As EV adoption increases, CEAT’s ability to develop high-performance tires for electric vehicles will be crucial for long-term growth.

-

Sustainability & Green Initiatives – Investments in eco-friendly tire production and compliance with environmental regulations can attract ESG-focused investors and customers.

-

Infrastructure & Road Development – Government-led infrastructure projects, including highway expansions, will boost demand for commercial vehicle and passenger car tires.

-

Competitive Landscape – Competition from domestic and global tire manufacturers may impact CEAT’s market share, pricing strategies, and innovation pace.

-

Cost Management & Profitability – Managing raw material costs, optimizing manufacturing efficiency, and improving financial performance will influence CEAT’s long-term stock price.

-

Macroeconomic Factors – Inflation, interest rates, global trade policies, and economic conditions will impact consumer demand and CEAT’s overall business growth leading up to 2030.

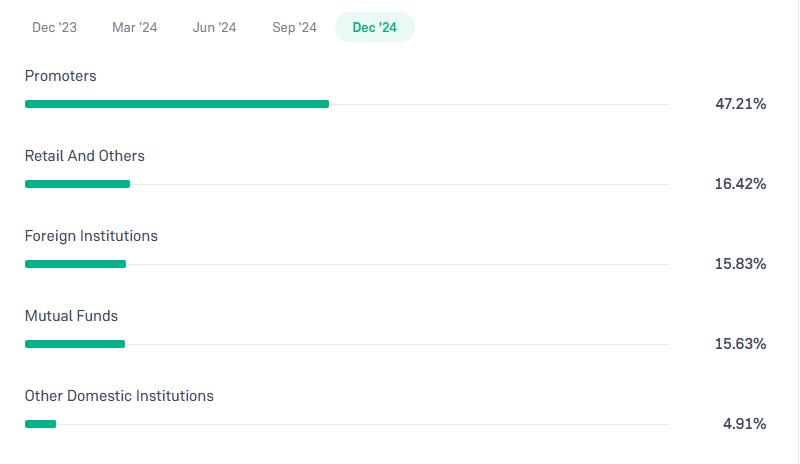

CEAT Shareholding Pattern

| Promoters | 47.21% |

| FII | 15.83% |

| DII | 20.54% |

| Public | 16.42% |

Read Also:- GMR Power Share Price Target 2025 To 2030- Current Chart, Market Overview