Bajaj Auto Share Price Target 2025 To 2030- Current Chart, Market Overview

Bajaj Auto is one of India’s most trusted and popular automobile companies, known for making strong, reliable, and stylish two-wheelers and three-wheelers. With a proud history and a global presence, Bajaj Auto has always focused on innovation and performance. Whether it’s motorcycles, scooters, or auto-rickshaws, the company offers vehicles that suit different needs and budgets. In recent years, Bajaj Auto has also been investing in electric vehicles, showing its commitment to a greener future. Bajaj Auto Share Price on NSE as of 9 April 2025 is 7,519.95 INR.

Bajaj Auto Share Price Chart

Bajaj Auto Market Overview

- Open: 7,384.50

- High: 7,529.85

- Low: 7,345.75

- Previous Close: 7,306.80

- Volume: 259,199

- Value (Lacs): 19,434.87

- UC Limit: 0.00

- LC Limit: 0.00

- 52 Week High: 12,774.00

- 52 Week Low: 7,089.35

- Mkt Cap (Rs. Cr.): 209,388

- Face Value: 10

Bajaj Auto Share Price Target 2025 To 2030

| Bajaj Auto Share Price Target Years | Bajaj Auto Share Price |

| 2025 | ₹12,780 |

| 2026 | ₹13,450 |

| 2027 | ₹13,910 |

| 2028 | ₹14,600 |

| 2029 | ₹15,120 |

| 2030 | ₹15,700 |

Bajaj Auto Share Price Target 2025

Bajaj Auto share price target 2025 Expected target could be ₹12,780. Here are 8 key factors affecting the growth for Bajaj Auto Share Price Target 2025:

-

Domestic and International Demand

Growth in demand for two-wheelers and three-wheelers, both in India and international markets, will directly impact Bajaj Auto’s revenue and stock performance. -

Electric Vehicle (EV) Expansion

Bajaj Auto’s efforts in the EV segment, like the Chetak electric scooter, can boost future growth as EV adoption increases across the country. -

Raw Material Prices

Fluctuation in the prices of key raw materials like steel, aluminium, and plastics can affect production costs and margins. -

Government Policies & Regulations

Supportive policies such as subsidies for electric vehicles and favourable export regulations will benefit the company, while stricter emission norms may increase costs. -

Competition in the Market

Intense competition from players like Hero MotoCorp, TVS Motors, and new EV startups can influence market share and pricing strategies. -

Export Growth

Bajaj Auto is a major exporter of two-wheelers and three-wheelers. Growth in African, Latin American, and Southeast Asian markets can drive overall performance. -

Technological Advancements

Continuous investment in innovation and new product development keeps Bajaj Auto competitive and attractive to investors. -

Economic Environment

Economic factors like inflation, interest rates, and overall consumer sentiment will play a role in automobile sales and thereby affect the company’s stock price.

Bajaj Auto Share Price Target 2030

Bajaj Auto share price target 2030 Expected target could be ₹15,700. Here are 8 key factors affecting the growth for Bajaj Auto Share Price Target 2030:

-

Strong Focus on Electric Vehicles (EVs)

By 2030, the shift towards electric mobility will be much stronger. Bajaj Auto’s investments in EVs like electric scooters and possible electric motorcycles can significantly drive growth. -

Global Market Expansion

Continued growth in exports and expansion into new markets across Africa, Latin America, and Asia will boost revenue streams. -

Product Innovation & R&D

Launching innovative, fuel-efficient, and eco-friendly models will help Bajaj Auto maintain a competitive edge in the evolving automobile sector. -

Government Initiatives for Green Mobility

Supportive government policies, incentives for EVs, and focus on reducing carbon emissions will favour companies like Bajaj Auto. -

Infrastructure Development

Better road infrastructure and increasing urbanisation in emerging markets will likely increase demand for two-wheelers and three-wheelers. -

Changing Consumer Preferences

Growing interest in personal mobility and stylish, performance-oriented bikes among young consumers can fuel sales growth. -

Economic Growth and Rising Incomes

A stronger economy and higher disposable incomes by 2030 will likely boost demand for Bajaj Auto’s products. -

Strategic Partnerships & Collaborations

Partnerships with technology providers or foreign companies for EV development and battery technologies can further enhance growth potential.

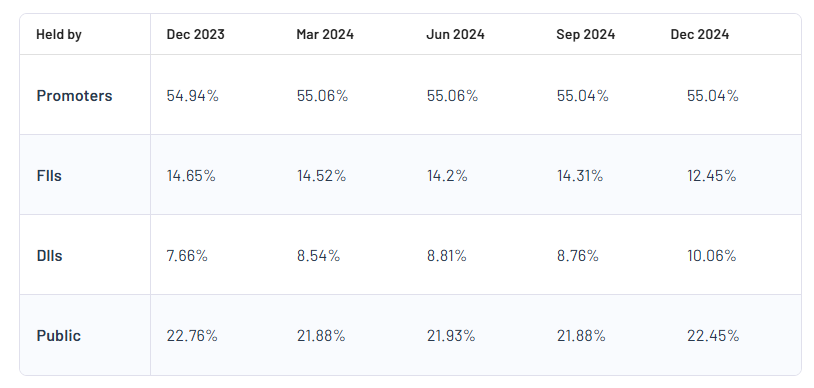

Bajaj Auto Shareholding Pattern

| Promoters | 55.04% |

| FII | 12.45% |

| DII | 10.06% |

| Public | 22.45% |

Read Also:- Radico Khaitan Share Price Target 2025 To 2030- Current Chart, Market Overview