Adani Total Gas Share Price Target 2025 To 2030- Current Chart, Market Overview

Adani Total Gas is a leading energy company in India, focusing on natural gas distribution. It is a joint venture between the Adani Group and TotalEnergies, a global energy giant. The company plays a key role in providing cleaner fuel solutions by supplying Compressed Natural Gas (CNG) for vehicles and Piped Natural Gas (PNG) for households, businesses, and industries. Adani Total Gas Share Price on NSE as of 4 April 2025 is 591.80 INR.

Adani Total Gas Share Price Chart

Adani Total Gas Market Overview

- Open: 606.00

- High: 608.55

- Low: 587.10

- Previous Close: 605.05

- Volume: 885,521

- Value (Lacs): 5,236.09

- VWAP: 594.02

- UC Limit: 665.55

- LC Limit: 544.55

- 52 Week High: 1,190.00

- 52 Week Low: 532.60

- Mkt Cap (Rs. Cr.): 65,031

- Face Value: 1

Adani Total Gas Share Price Target 2025 To 2030

| Adani Total Gas Share Price Target Years | Adani Total Gas Share Price |

| 2025 | ₹2000 |

| 2026 | ₹2200 |

| 2027 | ₹2400 |

| 2028 | ₹2600 |

| 2029 | ₹2800 |

| 2030 | ₹3000 |

Adani Total Gas Share Price Target 2025

Adani Total Gas share price target 2025 Expected target could be ₹2000. Here are 8 Key Factors Affecting Growth for Adani Total Gas Share Price Target 2025:

-

Expansion of City Gas Distribution (CGD) – Adani Total Gas is rapidly expanding its gas pipeline network across India, which will drive revenue growth.

-

Rising Demand for Natural Gas – Increasing industrial, commercial, and household usage of PNG (Piped Natural Gas) and CNG (Compressed Natural Gas) will boost sales.

-

Government Policies & Support – Policies promoting clean energy and reducing dependency on traditional fuels will favor the company’s long-term growth.

-

Partnership with TotalEnergies – The strategic partnership with the global energy giant TotalEnergies provides strong technical and financial support.

-

Infrastructure & Smart City Projects – Growth in infrastructure, smart city initiatives, and urbanization will increase the demand for natural gas.

-

Fluctuations in Global LNG Prices – Changes in global liquefied natural gas (LNG) prices can impact margins and overall profitability.

-

Competition in the CGD Sector – Rival companies like GAIL, Indraprastha Gas, and Mahanagar Gas can affect market share and pricing strategies.

-

Technological Advancements & Sustainability Initiatives – Adoption of advanced gas distribution technologies and a focus on renewable energy solutions will enhance operational efficiency and market positioning.

Adani Total Gas Share Price Target 2030

Adani Total Gas share price target 2030 Expected target could be ₹3000. Here are 8 Key Factors Affecting Growth for Adani Total Gas Share Price Target 2030:

-

Long-Term Expansion in City Gas Distribution (CGD) – Adani Total Gas is expected to expand its CGD network across multiple cities, increasing its market presence and revenue streams.

-

Government Push for Clean Energy – Policies promoting natural gas as a cleaner alternative to coal and oil will boost the company’s growth.

-

Rising Demand for CNG & PNG – With growing urbanization and industries shifting to cleaner fuels, the demand for CNG and PNG will continue to rise.

-

Strategic Alliance with TotalEnergies – The continued partnership with TotalEnergies will provide technological expertise, financial stability, and global market insights.

-

LNG Import & Pricing Dynamics – The cost of imported liquefied natural gas (LNG) will play a crucial role in determining profitability, as fluctuating global prices impact margins.

-

Infrastructure Development & Smart Cities – Increased investments in infrastructure projects and smart city developments will drive higher adoption of gas-based energy solutions.

-

Adoption of Green Hydrogen & Renewable Energy – Adani Total Gas is expected to diversify into hydrogen and renewable gas projects, which will create new growth avenues.

-

Market Competition & Regulatory Changes – Growing competition from companies like GAIL, IGL, and MGL, along with potential regulatory shifts, may influence market share and profitability.

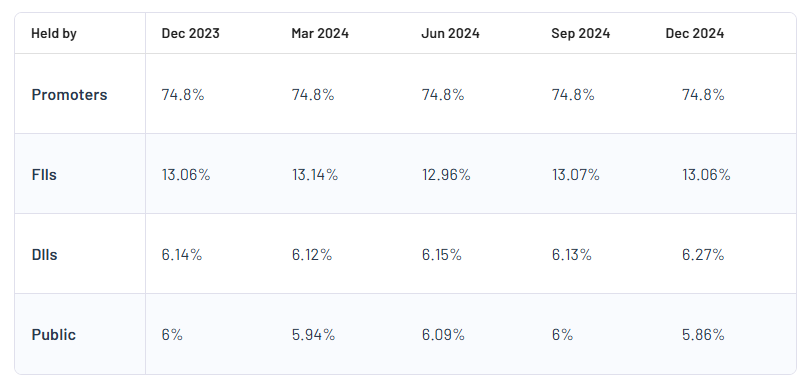

Adani Total Gas Shareholding Pattern

| Promoters | 74.8% |

| FII | 13.06% |

| DII | 6.27% |

| Public | 5.86% |

Read Also:- NIIT Share Price Target 2025 To 2030- Current Chart, Market Overview