MTNL Share Price Target 2025 To 2030- Current Chart, Market Overview

MTNL, also known as Mahanagar Telephone Nigam Limited, is a government-owned telecom company in India. It mainly provides services like mobile connections, landline phones, broadband, and enterprise solutions in metro cities such as Delhi and Mumbai. Over the years, MTNL has faced tough competition from private telecom operators, which has affected its growth. MTNL Share Price on NSE as of 12 April 2025 is 42.22 INR.

MTNL Share Price Chart

MTNL Market Overview

- Open: 42.97

- High: 42.97

- Low: 41.78

- Previous Close: 41.58

- Volume: 2,038,911

- Value (Lacs): 867.76

- VWAP: 42.26

- UC Limit: 49.89

- LC Limit: 33.26

- 52 Week High: 101.93

- 52 Week Low: 32.55

- Mkt Cap (Rs. Cr.): 2,681

- Face Value: 10

MTNL Share Price Target 2025 To 2030

| MTNL Share Price Target Years | MTNL Share Price |

| 2025 | ₹105 |

| 2026 | ₹115 |

| 2027 | ₹125 |

| 2028 | ₹135 |

| 2029 | ₹145 |

| 2030 | ₹155 |

MTNL Share Price Target 2025

MTNL share price target 2025 Expected target could be ₹105. Here are 8 key factors that could affect the growth of MTNL’s share price target for 2025:

-

Government Support and Policy Changes: MTNL, a state-owned telecom company, relies heavily on government support and policy decisions. Any changes in telecom policies, especially those favoring public sector companies, can impact its growth prospects.

-

Revenue from 4G and 5G Spectrum: MTNL’s ability to upgrade its infrastructure and expand its 4G and 5G services will be crucial for future growth. The rollout of these services can significantly improve its competitive edge and revenues.

-

Operational Efficiency and Cost Reduction: Improving operational efficiency and managing costs are essential for MTNL’s financial performance. The company has been underperforming in terms of profitability, so managing costs while improving service quality is a key factor.

-

Competition from Private Players: MTNL faces stiff competition from private telecom operators like Jio, Airtel, and Vodafone Idea, which are leading in terms of technology and customer base. How MTNL positions itself to compete with these giants will significantly impact its market share and stock performance.

-

Debt Levels and Financial Health: MTNL’s financial health is an important factor. The company has accumulated debt over the years, and its ability to manage and reduce debt will be crucial for improving investor sentiment and share price.

-

Technological Advancements: Innovation in technology, such as advancements in internet speed, 5G networks, and digital services, will have a significant impact on MTNL’s growth. Investment in modern technologies can improve customer experience and attract more users.

-

Subscriber Growth and Retention: MTNL’s ability to grow and retain its subscriber base, particularly in the face of competition from well-established telecom companies, will determine its long-term profitability and share price performance.

-

Regulatory Changes: Changes in telecom regulations, tariffs, and licensing can directly affect MTNL’s revenue streams. Regulatory frameworks that impact pricing, spectrum allocation, or financial assistance will play a critical role in its future growth trajectory.

MTNL Share Price Target 2030

MTNL share price target 2030 Expected target could be ₹155. Here are 8 key factors that could affect the growth of MTNL Share Price Target for 2030:

-

Successful Merger with BSNL (if materialized)

If the proposed merger of MTNL with BSNL happens smoothly, it could strengthen MTNL’s financials and operational efficiency, leading to better market presence and improved investor confidence. -

Expansion of 5G Services

MTNL’s ability to adopt and expand 5G technology will be a game-changer by 2030. A strong 5G rollout can attract more customers and boost revenue streams. -

Government Funding and Revival Plans

Continuous support from the government in the form of financial aid, spectrum allocation, and revival packages will play a major role in sustaining MTNL’s operations and future growth. -

Debt Management and Profitability Improvements

MTNL’s efforts to reduce its high debt burden and improve its profitability will be crucial for long-term growth and will directly influence its stock performance. -

Digital India Initiatives

Participation in government-led digital initiatives can open new avenues for MTNL, enhancing its service portfolio and increasing its relevance in the telecom space. -

Market Competition and Pricing Strategy

The aggressive pricing and service models of private players will continue to pressure MTNL. Its ability to compete while maintaining quality services will determine its market share. -

Adoption of New Technologies

Integrating modern technologies like IoT (Internet of Things), cloud services, and fiber-to-the-home (FTTH) solutions can diversify MTNL’s offerings and increase revenue opportunities. -

Subscriber Growth in Metro Cities

As MTNL primarily operates in metro areas like Delhi and Mumbai, increasing its subscriber base in these dense markets will be essential for future profitability and share price growth by 2030.

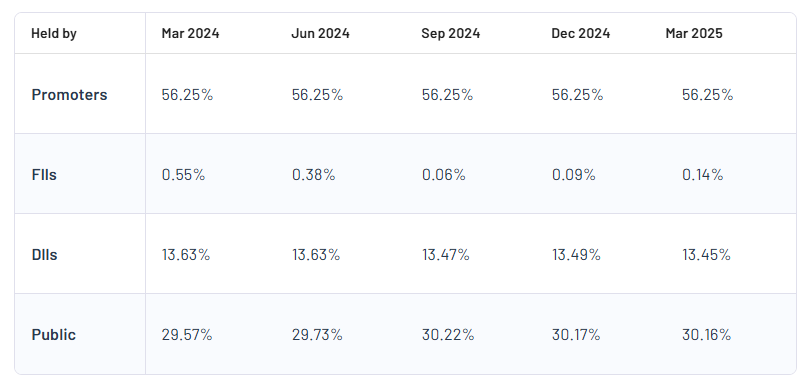

MTNL Shareholding Pattern

| Promoters | 56.25% |

| FII | 0.14% |

| DII | 13.45% |

| Public | 30.16% |

Read Also:- RIL Share Price Target 2025 To 2030- Current Chart, Market Overview