IOB Share Price Target 2025 To 2030- Current Chart, Market Overview

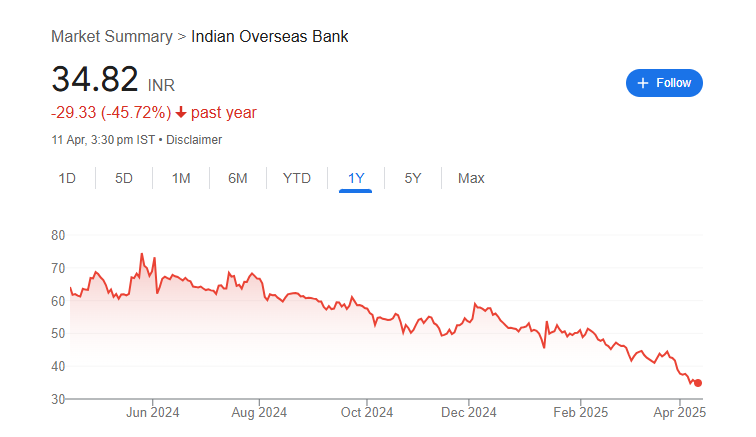

Indian Overseas Bank, commonly known as IOB, is one of the trusted public sector banks in India with a long history of serving millions of customers. The bank offers a wide range of services, including personal banking, corporate banking, and international services. In recent years, IOB has been focusing on improving its digital banking platforms to make banking easier and faster for its customers. The government’s support and various banking reforms have also helped strengthen the bank’s position. IOB Share Price on NSE as of 12 April 2025 is 34.82 INR.

IOB Share Price Chart

IOB Market Overview

- Open: 36.21

- High: 36.25

- Low: 34.67

- Previous Close: 35.18

- Volume: 8,208,240

- Value (Lacs): 2,867.14

- VWAP: 35.10

- UC Limit: 42.21

- LC Limit: 28.14

- 52 Week High: 75.55

- 52 Week Low: 33.50

- Mkt Cap (Rs. Cr.): 66,026

- Face Value: 10

IOB Share Price Target 2025 To 2030

| IOB Share Price Target Years | IOB Share Price |

| 2025 | ₹80 |

| 2026 | ₹100 |

| 2027 | ₹120 |

| 2028 | ₹140 |

| 2029 | ₹160 |

| 2030 | ₹180 |

IOB Share Price Target 2025

IOB share price target 2025 Expected target could be ₹80. Here are 8 key factors affecting the growth of Indian Overseas Bank (IOB) share price target for 2025:

-

Improvement in Asset Quality

If IOB manages to reduce bad loans (NPAs), it will improve the bank’s financial health, which can positively impact its share price. -

Government Support and Reforms

As a public sector bank, strong backing and reforms by the government can boost investor confidence in IOB. -

Credit Growth

Higher demand for loans from businesses and individuals will increase the bank’s income, supporting share price growth. -

Interest Rate Movements

Changes in interest rates by the RBI will directly affect IOB’s lending rates and margins, influencing profitability. -

Digital Transformation

Investment in digital banking and technology upgrades can attract more customers and improve operational efficiency. -

Economic Recovery

A growing economy leads to better business opportunities for the bank, helping it to grow its loan book and revenues. -

Competition in the Banking Sector

How well IOB competes with private banks and other PSUs will play a role in its growth story. -

Regulatory Environment

Changes in banking regulations and policies from the RBI and other authorities can either support or challenge the bank’s progress.

IOB Share Price Target 2030

IOB share price target 2030 Expected target could be ₹180. Here are 8 key factors affecting the growth of Indian Overseas Bank (IOB) share price target for 2030:

-

Long-Term Economic Growth

A strong and stable Indian economy by 2030 will create more opportunities for IOB to expand its lending and services. -

Expansion of Retail and MSME Loans

Growth in personal loans and loans to small businesses will support IOB’s revenue and market share. -

Technological Advancement

Continued investment in digital banking, mobile apps, and online services will help IOB reach more customers and improve efficiency. -

Government Initiatives for Public Sector Banks

Long-term supportive policies, recapitalization, and reforms for public banks will be crucial for IOB’s sustained growth. -

Asset Quality Management

Maintaining low levels of bad loans (NPAs) will ensure steady profits and keep investor confidence high. -

Branch Expansion and Rural Penetration

Expanding into rural and semi-urban areas can help IOB tap into underserved markets and grow its customer base. -

Global Exposure and Forex Services

Growth in international banking and foreign exchange services can open new revenue streams for IOB. -

Sustainability and Green Financing

Embracing sustainable banking practices and financing green projects could attract responsible investors and enhance the bank’s reputation.

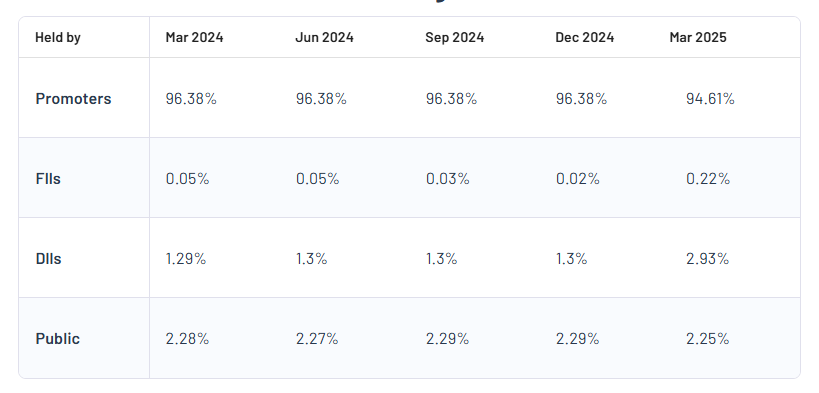

IOB Shareholding Pattern

| Promoters | 94.61% |

| FII | 0.22% |

| DII | 2.93% |

| Public | 2.25% |

Read Also:- HPCL Share Price Target 2025 To 2030- Current Chart, Market Overview