HPCL Share Price Target 2025 To 2030- Current Chart, Market Overview

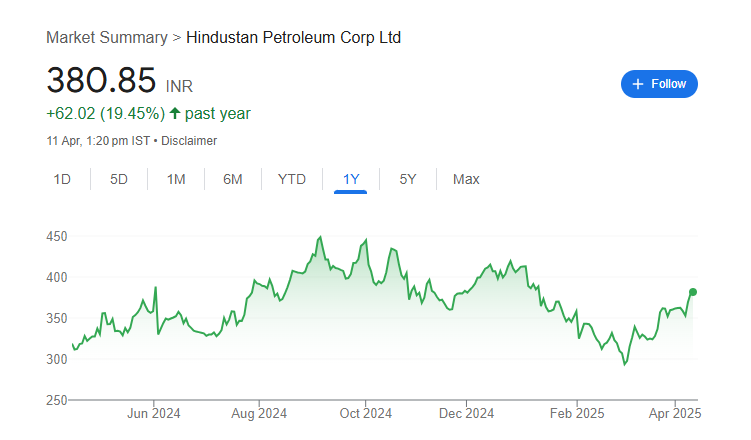

Hindustan Petroleum Corporation Limited, commonly known as HPCL, is one of India’s leading oil and gas companies. It plays an important role in refining crude oil and distributing petroleum products across the country. HPCL owns several refineries and a wide network of fuel stations, making energy accessible to millions of people every day. In recent years, the company has also started focusing on clean energy solutions, such as electric vehicle charging stations and renewable energy projects. HPCL Share Price on NSE as of 12 April 2025 is 380.85 INR.

HPCL Share Price Chart

HPCL Market Overview

- Open: 384.50

- High: 386.75

- Low: 377.05

- Previous Close: 379.30

- Volume: 7,217,670

- Value (Lacs): 27,585.93

- VWAP: 381.01

- UC Limit: 417.20

- LC Limit: 341.40

- 52 Week High: 457.15

- 52 Week Low: 287.55

- Mkt Cap (Rs. Cr.): 81,325

- Face Value: 10

HPCL Share Price Target 2025 To 2030

| HPCL Share Price Target Years | HPCL Share Price |

| 2025 | ₹460 |

| 2026 | ₹520 |

| 2027 | ₹580 |

| 2028 | ₹640 |

| 2029 | ₹700 |

| 2030 | ₹760 |

HPCL Share Price Target 2025

HPCL share price target 2025 Expected target could be ₹460. Here are 8 key factors affecting the growth of HPCL (Hindustan Petroleum Corporation Limited) share price target for 2025:

-

Crude Oil Price Volatility

HPCL’s performance is closely linked to global crude oil prices. Fluctuations can directly impact its refining margins and profitability. -

Government Policies & Regulations

Changes in fuel pricing policies, subsidies, and taxes imposed by the government can significantly influence HPCL’s earnings. -

Refining Capacity Expansion

HPCL’s ongoing investments in expanding its refining and distribution capacity can support future growth and improve market share. -

Energy Transition Initiatives

HPCL’s focus on cleaner energy sources, including biofuels and EV charging infrastructure, will play a role in shaping its future prospects. -

Demand for Petroleum Products

Growth in sectors like transportation, aviation, and industry will increase demand for fuel, positively impacting HPCL’s revenue. -

Global Geopolitical Tensions

International events and conflicts affecting oil supply routes can impact HPCL’s costs and overall profitability. -

Currency Fluctuations

As crude oil is imported, the strength of the Indian Rupee against the US Dollar can influence HPCL’s input costs. -

Competition from Private Players

Increasing competition from private oil companies and alternative energy providers may pressure HPCL’s market share and pricing power.

HPCL Share Price Target 2030

HPCL share price target 2030 Expected target could be ₹760. Here are 8 key factors affecting the growth of HPCL (Hindustan Petroleum Corporation Limited) share price target for 2030:

-

Shift Towards Renewable Energy

HPCL’s adaptability to the global energy transition and its investments in renewable energy will be crucial for long-term growth. -

Electric Vehicle (EV) Adoption

The increasing use of electric vehicles could reduce the demand for traditional fuels, impacting HPCL’s core business. -

Expansion of Petrochemical Business

HPCL’s expansion into petrochemicals can diversify its revenue streams and reduce dependency on fuel sales. -

Technological Advancements

Adoption of advanced refining technologies can improve efficiency and environmental compliance, supporting profitability. -

Global Crude Oil Supply Dynamics

Long-term trends in global crude oil supply and prices will continue to shape HPCL’s cost structure and margins. -

Regulatory Environment and Carbon Policies

Stricter environmental regulations and carbon pricing mechanisms may require HPCL to invest heavily in cleaner technologies. -

International Partnerships & Investments

Strategic collaborations and overseas ventures can open new growth avenues for HPCL by tapping into global markets. -

Indian Economy Growth

India’s economic growth will drive energy demand across industries, supporting HPCL’s long-term revenue potential.

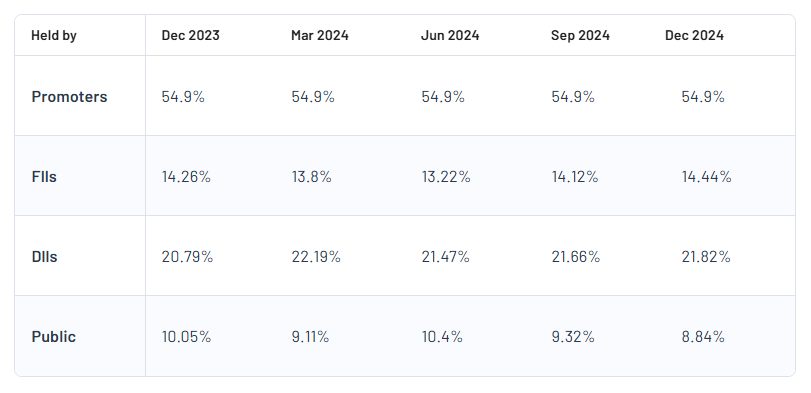

HPCL Shareholding Pattern

| Promoters | 54.9% |

| FII | 14.44% |

| DII | 21.82% |

| Public | 8.84% |

Read Also:- Coffee Day Share Price Target 2025 To 2030- Current Chart, Market Overview