Sona BLW Precision Forgings Share Price Target 2025 To 2030- Current Chart, Market Overview

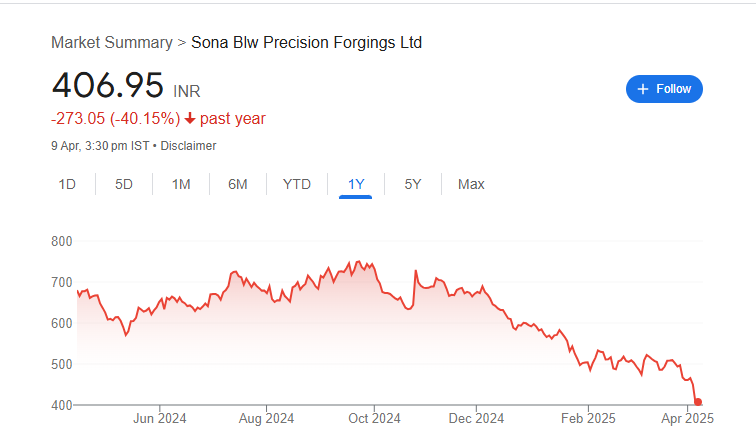

Sona BLW Precision Forgings is a well-known company in India that makes advanced parts for automobiles. The company is especially strong in producing components for electric vehicles, which is a fast-growing market. They design and manufacture products like gears, motors, and differential assemblies that are used by big car manufacturers across the world. Sona BLW Precision Forgings Share Price on NSE as of 11 April 2025 is 406.95 INR.

Sona BLW Precision Forgings Share Price Chart

Sona BLW Precision Forgings Market Overview

- Open: 410.00

- High: 413.00

- Low: 402.30

- Previous Close: 411.05

- Volume: 1,164,353

- Value (Lacs): 4,744.16

- UC Limit: 0.00

- LC Limit: 0.00

- 52 Week High: 768.65

- 52 Week Low: 380.00

- Mkt Cap (Rs. Cr.): 25,331

- Face Value: 10

Sona BLW Precision Forgings Share Price Target 2025 To 2030

| Sona BLW Precision Forgings Share Price Target Years | Sona BLW Precision Forgings Share Price |

| 2025 | ₹800 |

| 2026 | ₹1000 |

| 2027 | ₹1200 |

| 2028 | ₹1400 |

| 2029 | ₹1600 |

| 2030 | ₹1800 |

Sona BLW Precision Forgings Share Price Target 2025

Sona BLW Precision Forgings share price target 2025 Expected target could be ₹800. 8 key factors that could affect the growth of Sona BLW Precision Forgings Share Price Target for 2025:

-

Electric Vehicle (EV) Growth

Sona BLW is a major supplier of components for electric vehicles. As the global EV market expands, the company stands to benefit significantly. -

Diversification of Product Portfolio

The company’s focus on innovative products like differential assemblies and motors for EVs can help boost revenue and market share. -

Export Opportunities

A strong global presence, especially in Europe and North America, can increase exports and revenue growth. -

Government Support for EVs

Policies promoting electric mobility and incentives for green technologies can further accelerate the company’s growth. -

Technological Advancements

Investment in R&D and adoption of advanced manufacturing technologies can improve efficiency and attract more clients. -

Raw Material Costs

Fluctuation in the prices of raw materials like steel and rare earth elements could impact profit margins. -

Supply Chain Stability

A smooth supply chain without major disruptions is crucial for timely deliveries and sustained growth. -

Global Economic Conditions

Economic growth or slowdown in key markets will influence demand for automobiles, and in turn, Sona BLW’s business performance.

Sona BLW Precision Forgings Share Price Target 2030

Sona BLW Precision Forgings share price target 2030 Expected target could be ₹1800. Here are 8 key factors that could affect the growth of Sona BLW Precision Forgings share price target for 2030:

-

Electric Vehicle (EV) Market Growth

As Sona BLW supplies critical components for EVs, the expansion of the EV industry worldwide will significantly boost the company’s revenue and profitability. -

Technological Advancements

Investment in research and development for next-generation mobility solutions, like lightweight components and energy-efficient systems, can enhance their market leadership. -

Global Expansion

Growth in international markets and new customer acquisitions across Europe, North America, and Asia can open up new revenue streams. -

Government Policies and Incentives

Supportive policies for clean energy vehicles and incentives for local manufacturing could positively impact demand for Sona BLW’s products. -

Strategic Partnerships

Collaborations with leading automobile companies and technology providers can help the company stay ahead in the competitive auto component sector. -

Raw Material Costs

Fluctuations in steel and other raw material prices could influence the company’s margins and overall financial performance. -

Supply Chain Stability

Efficient management of global supply chains and avoidance of disruptions will be crucial for meeting growing demand. -

Shift Towards Green Mobility

Rising environmental awareness and global push for carbon neutrality will increase demand for energy-efficient automotive components, benefitting the company.

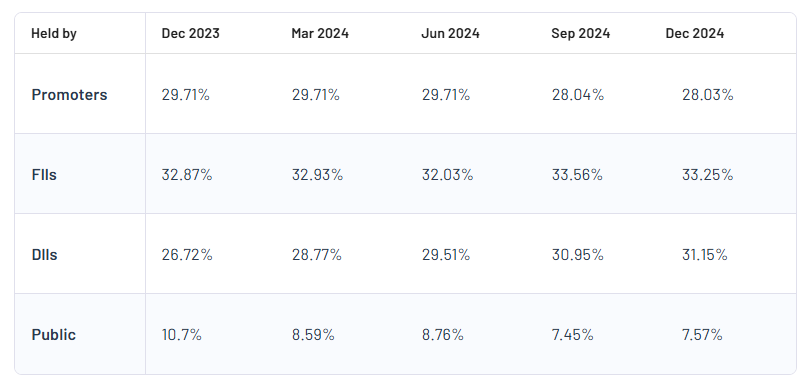

Sona BLW Precision Forgings Shareholding Pattern

| Promoters | 28.03% |

| FII | 33.25% |

| DII | 31.15% |

| Public | 7.57% |

Read Also:- Sonata Software Share Price Target 2025 To 2030- Current Chart, Market Overview