Igarashi Motors Share Price Target 2025 To 2030- Current Chart, Market Overview

Igarashi Motors is a well-known company that makes small electric motors used in many products, like cars, home appliances, and industrial machines. The company is especially famous for its role in the automobile sector, where its motors help power things like window lifts, seats, and mirrors. Igarashi Motors Share Price on NSE as of 9 April 2025 is 438.00 INR.

Igarashi Motors Share Price Chart

Igarashi Motors Market Overview

- Open: 425.00

- High: 444.70

- Low: 416.95

- Previous Close: 420.70

- Volume: 72,886

- Value (Lacs): 320.08

- UC Limit: 0.00

- LC Limit: 0.00

- 52 Week High: 848.95

- 52 Week Low: 401.05

- Mkt Cap (Rs. Cr.): 1,382

- Face Value: 10

Igarashi Motors Share Price Target 2025 To 2030

| Igarashi Motors Share Price Target Years | Igarashi Motors Share Price |

| 2025 | ₹850 |

| 2026 | ₹1000 |

| 2027 | ₹1200 |

| 2028 | ₹1400 |

| 2029 | ₹1600 |

| 2030 | ₹1800 |

Igarashi Motors Share Price Target 2025

Igarashi Motors share price target 2025 Expected target could be ₹850. Here are 8 key factors that could affect the growth of Igarashi Motors’ share price target for 2025:

-

Electric Vehicle (EV) Industry Growth

As Igarashi Motors supplies motors for EVs, the rising global and domestic adoption of electric vehicles will directly support its revenue growth. -

Expansion in Export Markets

Strong demand from overseas markets, especially from Europe and the USA, can boost export revenues and improve profitability. -

Technological Innovation

Continued innovation in motor design, efficiency, and performance will help Igarashi Motors stay competitive and attract more clients. -

Raw Material Costs

Fluctuations in the prices of copper and steel, essential for motor manufacturing, could impact production costs and profit margins. -

Strategic Partnerships and Alliances

Collaborations with global auto manufacturers and component suppliers can open new business opportunities and strengthen market presence. -

Government Policies and Incentives

Supportive policies for the EV sector and local manufacturing initiatives like “Make in India” can provide growth momentum. -

Currency Exchange Rates

As a company with significant exports, favorable forex rates can positively influence earnings, while adverse movements may pose risks. -

Economic Conditions in Key Markets

Economic stability and demand in the automotive sector, both in India and globally, will play a big role in shaping future growth.

Igarashi Motors Share Price Target 2030

Igarashi Motors share price target 2030 Expected target could be ₹1800. Here are 8 key factors that could affect the growth of Igarashi Motors’ share price target for 2030:

-

Long-Term Electric Vehicle Adoption

By 2030, the global shift towards electric mobility is expected to be much stronger, which could significantly boost demand for Igarashi Motors’ products. -

Product Diversification

Expanding into new categories like motors for industrial automation, home appliances, and other sectors can open up fresh revenue streams. -

Sustainability and Green Manufacturing

A focus on eco-friendly production processes and energy-efficient motors will align with global sustainability goals and attract environmentally conscious customers. -

Global Supply Chain Stability

Building a resilient and diversified supply chain can protect the company from disruptions and ensure smooth operations in the long term. -

Research & Development Investments

Consistent investment in R&D to improve technology and innovate advanced motor solutions will keep the company ahead in a competitive market. -

Automation and Industry 4.0 Trends

Growing adoption of automation across industries worldwide will increase the demand for precision motors, benefiting Igarashi Motors. -

Market Expansion in Emerging Economies

Tapping into emerging markets like Southeast Asia, Africa, and Latin America can offer new growth opportunities by 2030. -

Regulatory Changes and EV Mandates

Stricter regulations on emissions and more aggressive EV adoption mandates globally will further accelerate the demand for Igarashi Motors’ components.

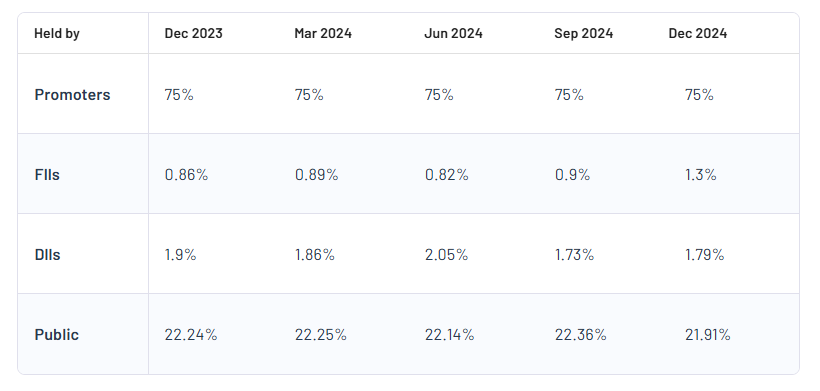

Igarashi Motors Shareholding Pattern

| Promoters | 75% |

| FII | 1.3% |

| DII | 1.79% |

| Public | 21.91% |

Read Also:- GSFC Share Price Target 2025 To 2030- Current Chart, Market Overview