DLF Share Price Target 2025 To 2030- Current Chart, Market Overview

DLF Limited is one of India’s largest and most well-known real estate companies, with a long history of building beautiful homes, modern office spaces, and premium shopping centers. Founded in 1946, DLF has played a big role in shaping India’s urban landscape. The company focuses on creating world-class living and working spaces, always keeping quality and customer satisfaction in mind. Over the years, DLF has expanded its presence across many cities and continues to grow by embracing sustainable practices and smart technology. DLF Share Price on NSE as of 8 April 2025 is 624.00 INR.

DLF Share Price Chart

DLF Market Overview

- Open: 621.05

- High: 632.90

- Low: 611.25

- Previous Close: 608.05

- Volume: 3,688,073

- Value (Lacs: 22,923.22

- VWAP: 620.94

- UC Limit: 668.85

- LC Limit: 547.25

- 52 Week High: 930.65

- 52 Week Low: 601.20

- Mkt Cap (Rs. Cr.): 153,853

- Face Value: 2

DLF Share Price Target 2025 To 2030

| DLF Share Price Target Years | DLF Share Price |

| 2025 | ₹940 |

| 2026 | ₹1050 |

| 2027 | ₹1150 |

| 2028 | ₹1250 |

| 2029 | ₹1350 |

| 2030 | ₹1450 |

DLF Share Price Target 2025

DLF share price target 2025 Expected target could be ₹940. Here are 8 key factors affecting the growth of DLF share price target for 2025:

-

Real Estate Market Demand

The overall demand for residential and commercial properties in India will play a big role in DLF’s growth. Higher demand can boost sales and profits. -

Government Policies & Reforms

Policies like reduced stamp duty, housing schemes, and support for affordable housing can positively impact DLF’s growth. -

Interest Rates and Home Loans

Lower interest rates make home loans cheaper, encouraging people to buy property, which benefits DLF. -

Urbanization and Infrastructure Development

Rapid urban development and better infrastructure in cities increase the value of DLF’s properties and attract more buyers. -

Commercial Leasing and Rental Income

Growth in leasing out commercial spaces (like offices and malls) provides a steady rental income, supporting DLF’s financial health. -

Company’s Project Pipeline

Successful completion and launch of new projects can increase revenue and investor confidence. -

Economic Growth of India

A stronger economy boosts buying capacity, investments, and corporate demand for real estate, helping DLF’s business grow. -

Brand Reputation and Trust

DLF’s strong brand image and history of delivering quality projects play a big role in attracting buyers and investors.

DLF Share Price Target 2030

DLF share price target 2030 Expected target could be ₹1450. Here are 8 key factors affecting the growth of DLF share price target for 2030:

-

Long-Term Urbanization Trends

As more people move to cities over the next few years, the demand for both homes and office spaces is expected to grow, benefiting DLF. -

Expansion into Tier 2 and Tier 3 Cities

DLF’s plans to expand beyond metro cities into smaller towns can open new markets and boost future revenues. -

Sustainability and Green Projects

Growing focus on eco-friendly construction and sustainable buildings can attract environment-conscious buyers and investors. -

Technological Advancements in Real Estate

Use of smart technologies and digital platforms for property management and sales can enhance customer experience and operational efficiency. -

Global Investment and Partnerships

Collaborations with international investors and developers can bring in fresh capital and new opportunities for large-scale projects. -

Government’s Smart City Initiatives

Participation in Smart City projects can give DLF access to government-supported infrastructure developments and boost growth. -

Growth of Commercial Real Estate

Increasing demand for high-quality office spaces, malls, and logistics hubs will provide a stable income stream for DLF. -

Company’s Debt Management and Financial Health

Efficient management of debt and strong balance sheet will improve investor confidence and support share price growth in the long term.

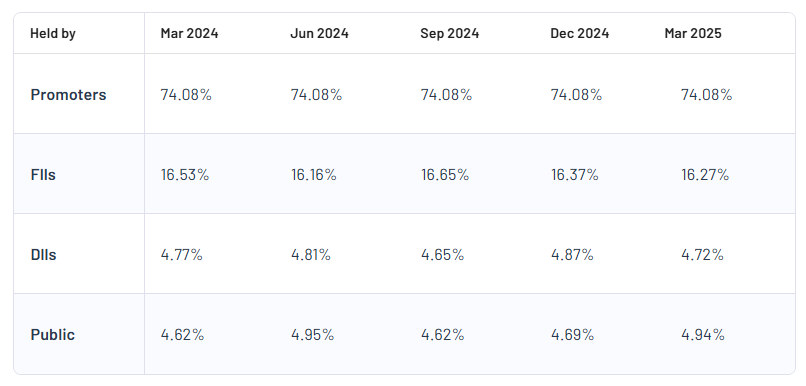

DLF Shareholding Pattern

| Promoters | 74.08% |

| FII | 16.27% |

| DII | 4.72% |

| Public | 4.94% |

Read Also:- Deepak Nitrite Share Price Target 2025 To 2030- Current Chart, Market Overview