Tamboli Industries Share Price Target 2025 To 2030- Current Chart, Market Overview

Tamboli Industries is a well-known company that specialises in making precision-engineered parts for different industries such as aerospace, oil & gas, and defence. With a strong focus on quality and innovation, the company has built a good reputation both in India and internationally. They use advanced technology and modern manufacturing processes to meet the high standards of their global clients. Tamboli Industries is also focused on expanding its product range and exploring new markets, which helps in driving steady growth. Tamboli Industries Share Price on NSE as of 7 April 2025 is 140.00 INR.

Tamboli Industries Share Price Chart

Tamboli Industries Market Overview

- Open: 140.00

- High: 140.00

- Low: 127.00

- Previous Close: 149.90

- Volume: 4,775

- Value (Lacs): 6.68

- VWAP: 134.54

- UC Limit: 167.15

- LC Limit: 111.45

- 52 Week High: 215.00

- 52 Week Low: 110.00

- Mkt Cap (Rs. Cr.): 138

- Face Value: 10

Tamboli Industries Share Price Target 2025 To 2030

| Tamboli Industries Share Price Target Years | Tamboli Industries Share Price |

| 2025 | ₹220 |

| 2026 | ₹240 |

| 2027 | ₹260 |

| 2028 | ₹280 |

| 2029 | ₹300 |

| 2030 | ₹320 |

Tamboli Industries Share Price Target 2025

Tamboli Industries share price target 2025 Expected target could be ₹220. Here are 8 key factors affecting the growth of Tamboli Industries Share Price Target for 2025:

-

Demand for Precision Components

Tamboli Industries makes precision components, and their growth depends on how much these parts are needed in industries like aerospace, automotive, and energy. -

Global Market Expansion

Expanding into global markets can boost sales and increase revenue, helping the share price grow steadily. -

Raw Material Prices

Fluctuations in the prices of metals and raw materials can directly impact the company’s production cost and profits. -

Technological Advancements

Investing in advanced manufacturing technologies can improve efficiency, reduce waste, and attract more customers. -

Partnerships & Collaborations

New business partnerships or collaborations with big industries can open up new opportunities for growth. -

Government Policies & Support

Policies supporting manufacturing and exports can benefit the company and strengthen its growth prospects. -

Financial Health & Earnings Growth

Strong quarterly earnings and healthy financial management can boost investor confidence and positively affect the share price. -

Global Economic Trends

Since Tamboli Industries also exports, global economic stability and trade relations will play an important role in their growth journey.

Tamboli Industries Share Price Target 2030

Tamboli Industries share price target 2030 Expected target could be ₹320. Here are 8 key factors affecting the growth of Tamboli Industries Share Price Target for 2030:

-

Long-Term Global Demand

The increasing need for precision-engineered components in sectors like aerospace, defence, and energy will support long-term growth. -

Sustainability Initiatives

Companies focusing on eco-friendly production and sustainable practices may attract more global clients and investors by 2030. -

Diversification of Product Portfolio

Expanding into new product lines and industries can reduce risks and open up multiple revenue streams. -

Automation & Industry 4.0 Adoption

Using smart manufacturing and automation can increase efficiency and reduce costs, helping the company stay competitive. -

Strengthening Export Markets

Growing exports and entering new international markets can significantly boost revenues over time. -

Stable Raw Material Supply Chain

Ensuring a reliable and cost-effective supply of raw materials will be crucial for maintaining profitability. -

Strategic Investments & Acquisitions

Wise investments in technology or acquiring complementary businesses can accelerate growth. -

Market Sentiment & Investor Confidence

Positive market perception, supported by consistent performance and transparent governance, will influence the stock price positively by 2030.

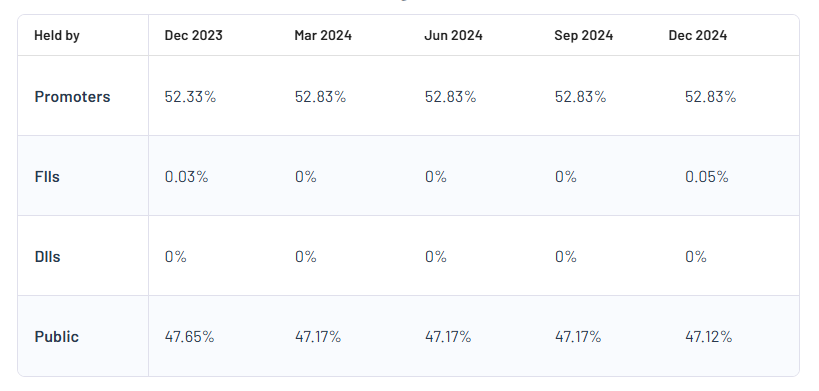

Tamboli Industries Shareholding Pattern

| Promoters | 52.83% |

| FII | 0.05% |

| DII | 0% |

| Public | 47.12% |

Read Also:- Indo Farm Equipment Share Price Target 2025 To 2030- Current Chart, Market Overview