Senco Gold Share Price Target 2025 To 2030- Current Chart, Market Overview

Senco Gold is one of India’s well-known jewellery brands, loved for its beautiful designs and trusted quality. With a long history in the jewellery business, Senco Gold offers a wide range of products, from traditional gold ornaments to modern diamond and platinum jewellery. The company focuses on making jewellery that suits every occasion and customer, blending tradition with new trends. Senco Gold is also expanding its presence across India, making its collections available both in stores and online. Senco Gold Share Price on NSE as of 5 April 2025 is 301.90 INR.

Senco Gold Share Price Chart

Senco Gold Market Overview

- Open: 312.00

- High: 317.40

- Low: 295.00

- Previous Close: 305.90

- Volume: 1,473,853

- Value (Lacs): 4,411.98

- VWAP: 305.10

- UC Limit: 321.15

- LC Limit: 290.60

- 52 Week High: 772.00

- 52 Week Low: 227.40

- Mkt Cap (Rs. Cr.): 4,899

- Face Value: 10

Senco Gold Share Price Target 2025 To 2030

| Senco Gold Share Price Target Years | Senco Gold Share Price |

| 2025 | ₹780 |

| 2026 | ₹900 |

| 2027 | ₹1000 |

| 2028 | ₹1100 |

| 2029 | ₹1200 |

| 2030 | ₹1300 |

Senco Gold Share Price Target 2025

Senco Gold share price target 2025 Expected target could be ₹780. Here are 8 key factors affecting the growth of Senco Gold share price target for 2025:

-

Gold Price Fluctuations

Since Senco Gold operates in the jewellery sector, any rise or fall in global and domestic gold prices will directly impact its sales and profitability. -

Consumer Demand and Festive Seasons

Higher consumer demand during festivals and wedding seasons can significantly boost Senco Gold’s revenue, helping improve its market position. -

Expansion of Retail Network

Opening new stores in growing markets and expanding its footprint in Tier-II and Tier-III cities can drive future sales growth. -

Brand Recognition and Marketing

Strong brand campaigns and celebrity endorsements help attract more customers and build trust, which supports higher sales and margins. -

Government Policies and Import Duties

Changes in import duties on gold and regulations in the jewellery sector can influence operational costs and pricing strategies. -

Competition in the Jewellery Market

Intense competition from both organised and unorganised players may affect Senco Gold’s market share and pricing power. -

Rising Disposable Income

As people’s incomes rise, their spending on luxury items like gold jewellery tends to increase, benefiting companies like Senco Gold. -

Digital and E-Commerce Growth

Expansion into online sales channels can help Senco Gold reach a wider audience and boost its sales beyond physical stores.

Senco Gold Share Price Target 2030

Senco Gold share price target 2030 Expected target could be ₹1300. Here are 8 key factors affecting the growth of Senco Gold share price target for 2030:

-

Long-Term Gold Price Trends

Sustained global demand and price trends of gold will play a major role in shaping Senco Gold’s future revenue and profitability. -

Retail Network Expansion

Aggressive expansion into untapped domestic and international markets can help Senco Gold capture a larger customer base by 2030. -

Adoption of Technology and E-commerce

Increasing focus on online jewellery sales and digital marketing can boost growth, making it easier to reach young and tech-savvy consumers. -

Consumer Preference for Branded Jewellery

The gradual shift from unorganised to organised jewellery brands will benefit established players like Senco Gold in the long run. -

Economic Growth and Rising Middle Class

India’s growing middle class and rising disposable income levels are expected to increase demand for premium jewellery products. -

Sustainability and Ethical Sourcing

Ethical business practices and responsible sourcing of gold and gems will attract conscious consumers and improve brand reputation. -

Government Regulations and Taxation

Stable and favourable government policies, including GST and import duties, will help the industry maintain healthy growth. -

Global Expansion Opportunities

Exploring international markets, especially regions with a strong demand for gold jewellery, can open new revenue streams by 2030.

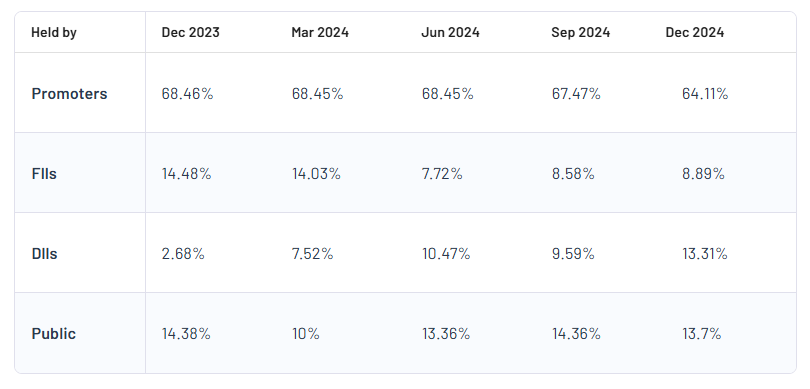

Senco Gold Shareholding Pattern

| Promoters | 64.11% |

| FII | 8.89% |

| DII | 13.31% |

| Public | 13.7% |

Read Also:- Indo Farm Equipment Share Price Target 2025 To 2030- Current Chart, Market Overview